08 May 2025 Nuveen Churchill Direct Lending Corp. (NCDL) First Quarter 2025 Earnings

2Nuveen Churchill Direct Lending Corp. Disclosure This presentation is for informational purposes only. It does not convey an offer of any type and is not intended to be, and should not be construed as, an offer to sell, or the solicitation of an offer to buy, any securities of Nuveen Churchill Direct Lending Corp. (the “Company,” “NCDL,” “we,” “us” or “our”). Any such offering can be made only at the time an offeree receives a prospectus relating to such offering and other operative documents which contain significant details with respect to risks and should be carefully read. In addition, the information in this presentation is qualified in its entirety by reference to the more detailed discussions contained in the Company’s public filings with the Securities and Exchange Commission (the “SEC”), including without limitation, the risk factors. Nothing in this presentation constitutes investment advice. You or your clients may lose money by investing in the Company. The Company is not intended to be a complete investment program and, due to the uncertainty inherent in all investments, there can be no assurance that the Company will achieve its investment objective. The information contained herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Prospective investors should also seek advice from their own independent tax, accounting, financial, investment and legal advisors to properly assess the merits and risks associated with an investment in the Company in light of their own financial condition and other circumstances. These materials and the presentations of which they are a part, and the summaries contained herein, do not purport to be complete and no obligation to update or otherwise revise such information is being assumed. Nothing shall be relied upon as a promise or representation as to the future performance of the Company. Such information is qualified in its entirety by reference to the more detailed discussions contained elsewhere in the Company’s public filings with the SEC. An investment in the Company is speculative and involves a high degree of risk. There can be no guarantee that the Company’s investment objective will be achieved. The Company may engage in other investment practices that may increase the risk of investment loss. An investor could lose all or substantially all of his, her or its investment. The Company may not provide periodic valuation information to investors, and there may be delays in distributing important tax information. The Company’s fees and expenses may be considered high and, as a result, such fees and expenses may offset the Company’s profits. For a summary of certain of these and other risks, please see the Company’s public filings with the SEC. There is no guarantee that any of the estimates, targets or projections illustrated in these materials and any presentation of which they form a part will be achieved. Any references herein to any of the Company’s past or present investments or its past or present performance, have been provided for illustrative purposes only. It should not be assumed that these investments were or will be profitable or that any future investments by the Company will be profitable or will equal the performance of these investments. Diversification of an investor’s portfolio does not assure a profit or protect against loss in a declining market. Opinions expressed reflect the current opinions of the Company as of the date appearing in the materials only and are based on the Company’s opinions of the current market environment, which is subject to change. Certain information contained in the materials discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. There can be no assurances that any of the trends described herein will continue or will not reverse. Past events and trends do not imply, predict or guarantee, and are not necessarily indicative of, future events or results. This presentation includes historical information and “forward-looking statements” with respect to the business and investments of NCDL, including, but not limited to, statements about NCDL’s future performance and financial performance and financial condition, which involve substantial risks and uncertainties. Such statements involve known and unknown risks, uncertainties and other factors and undue reliance should not be placed thereon. These forward-looking statements are not historical facts, but rather are based on current expectations, estimates and projections about us, our current and prospective portfolio investments, our industry, our beliefs, and our assumptions. Words such as “anticipates,” “expects,” “intends,” “plans,” “will,” “may,” “continue,” “believes,” “seeks,” “estimates,” “would,” “could,” “should,” “targets,” “projects,” “outlook,” “potential,” “predicts,” and variations of these words and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond NCDL’s control and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements, including, without limitation, the risks, uncertainties and other factors identified in NCDL’s filings with the Securities and Exchange Commission, including changes in the financial, capital, and lending markets; changes in the interest rate environment and its impact on NCDL’s business, its financial condition, and its portfolio companies; the uncertainty associated with the imposition of tariffs and trade barriers and changes in trade policy, and its impact on NCDL’s portfolio companies and the general economy; general economic, political and industry trends and other external factors, and the dependence of NCDL’s future success on the general economy and its impact on the industries in which it invests; and other risks, uncertainties and other factors we identify in the section entitled “Risk Factors” in NCDL’s most recent Annual Report on Form 10-K and most recent Quarterly Report on Form 10-Q, which are accessible on the SEC’s website at www.sec.gov. Investors should not place undue reliance on these forward-looking statements, which apply only as of the date on which NCDL makes them. NCDL does not undertake any obligation to update or revise any forward-looking statements or any other information contained herein, except as required by applicable law. We have based the forward-looking statements included in this presentation on information available to us on the date of this presentation, and we assume no obligation to update any such forward- looking statements. Should NCDL’s estimates, projections and assumptions or these other uncertainties and factors materialize in ways that NCDL did not expect, actual results could differ materially from the forward-looking statements in this presentation. All capitalized terms in the presentation have the same definitions as the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2025. Please see Endnotes at the end of this presentation for additional important information.

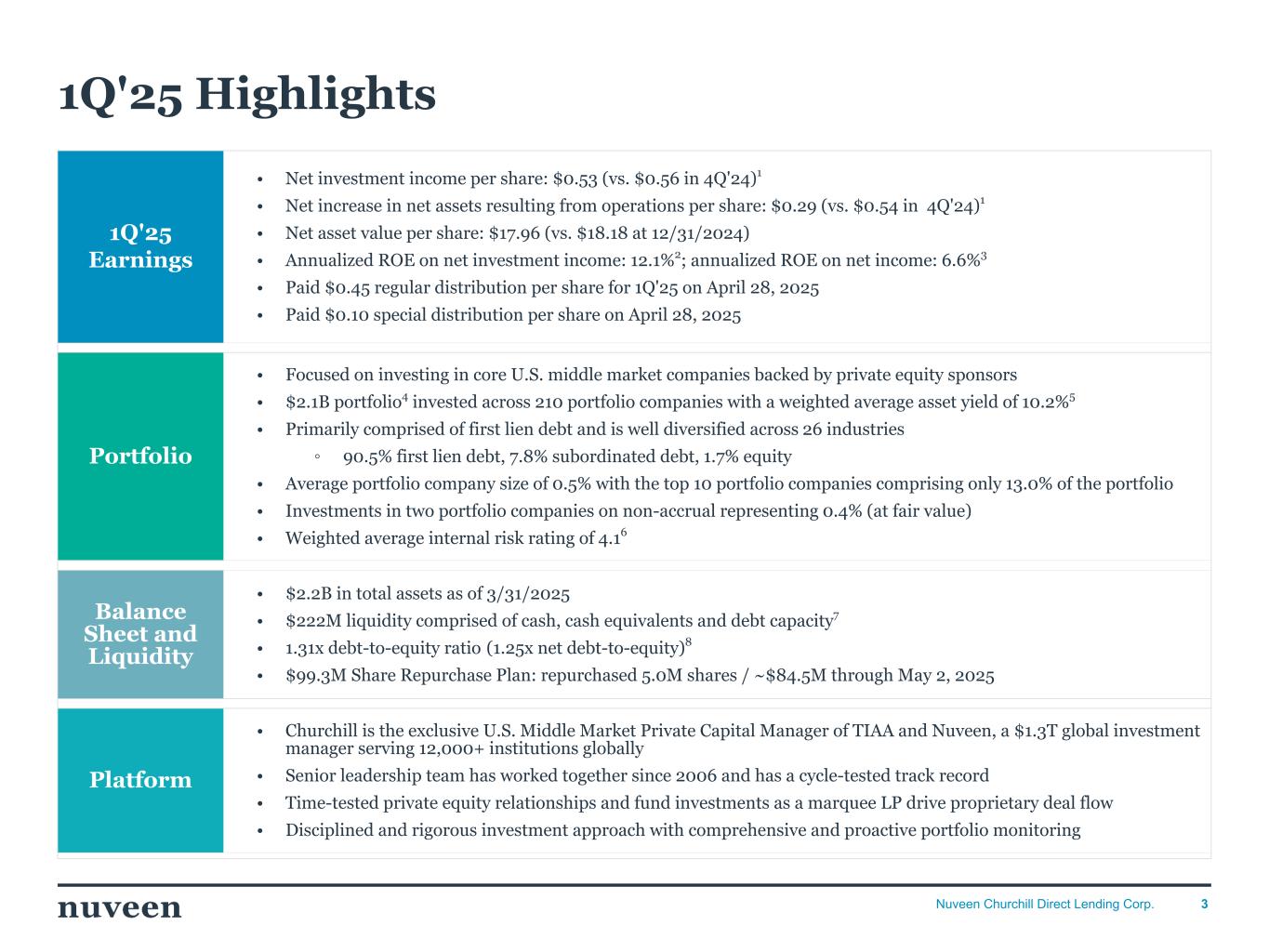

3Nuveen Churchill Direct Lending Corp. 1Q'25 Highlights Net Investment Income Per Share ($0.53) • Calculated based on WAVG shares outstanding throughout 1Q'25 • Investment Income increase ~ (5.3)% QovQ ◦ WAVG Yield, at Cost, decreased to 10.1% from 10.3% QovQ. ◦ Investment Balance increased to $2.1B O/S from $2.1B O/S • Expenses decrease by ~ 4% QoQ Net Income Per Share ($0.29) • Calculated based on WAVG shares outstanding throughout Q4 • Net Investment Income per share of $0.53 • Net realized and unrealized per share $(0.24) ◦ Notable U/R Gains & Losses ▪ Reversal of Seko & JEGS ~ $.24 ▪ ◦ Realized Gains & Losses ▪ Seko & Jegs (~ $.26) NAV Per Share ($17.96) • Calculated based on shares outstanding as of 03/31 • Increase due to NII of $0.53, while distributing $0.55, with net Unrealized & Realized Gain/Losses of $(0.24) Annual ROE on NII (12.1%) Annual ROE on NI (6.6%) • Calculated based on shares outstanding as of 03/31 1Q'25 Earnings • Net investment income per share: $0.53 (vs. $0.56 in 4Q'24)1 • Net increase in net assets resulting from operations per share: $0.29 (vs. $0.54 in 4Q'24)1 • Net asset value per share: $17.96 (vs. $18.18 at 12/31/2024) • Annualized ROE on net investment income: 12.1%2; annualized ROE on net income: 6.6%3 • Paid $0.45 regular distribution per share for 1Q'25 on April 28, 2025 • Paid $0.10 special distribution per share on April 28, 2025 Portfolio • Focused on investing in core U.S. middle market companies backed by private equity sponsors • $2.1B portfolio4 invested across 210 portfolio companies with a weighted average asset yield of 10.2%5 • Primarily comprised of first lien debt and is well diversified across 26 industries ◦ 90.5% first lien debt, 7.8% subordinated debt, 1.7% equity • Average portfolio company size of 0.5% with the top 10 portfolio companies comprising only 13.0% of the portfolio • Investments in two portfolio companies on non-accrual representing 0.4% (at fair value) • Weighted average internal risk rating of 4.16 Balance Sheet and Liquidity • $2.2B in total assets as of 3/31/2025 • $222M liquidity comprised of cash, cash equivalents and debt capacity7 • 1.31x debt-to-equity ratio (1.25x net debt-to-equity)8 • $99.3M Share Repurchase Plan: repurchased 5.0M shares / ~$84.5M through May 2, 2025 Platform • Churchill is the exclusive U.S. Middle Market Private Capital Manager of TIAA and Nuveen, a $1.3T global investment manager serving 12,000+ institutions globally • Senior leadership team has worked together since 2006 and has a cycle-tested track record • Time-tested private equity relationships and fund investments as a marquee LP drive proprietary deal flow • Disciplined and rigorous investment approach with comprehensive and proactive portfolio monitoring

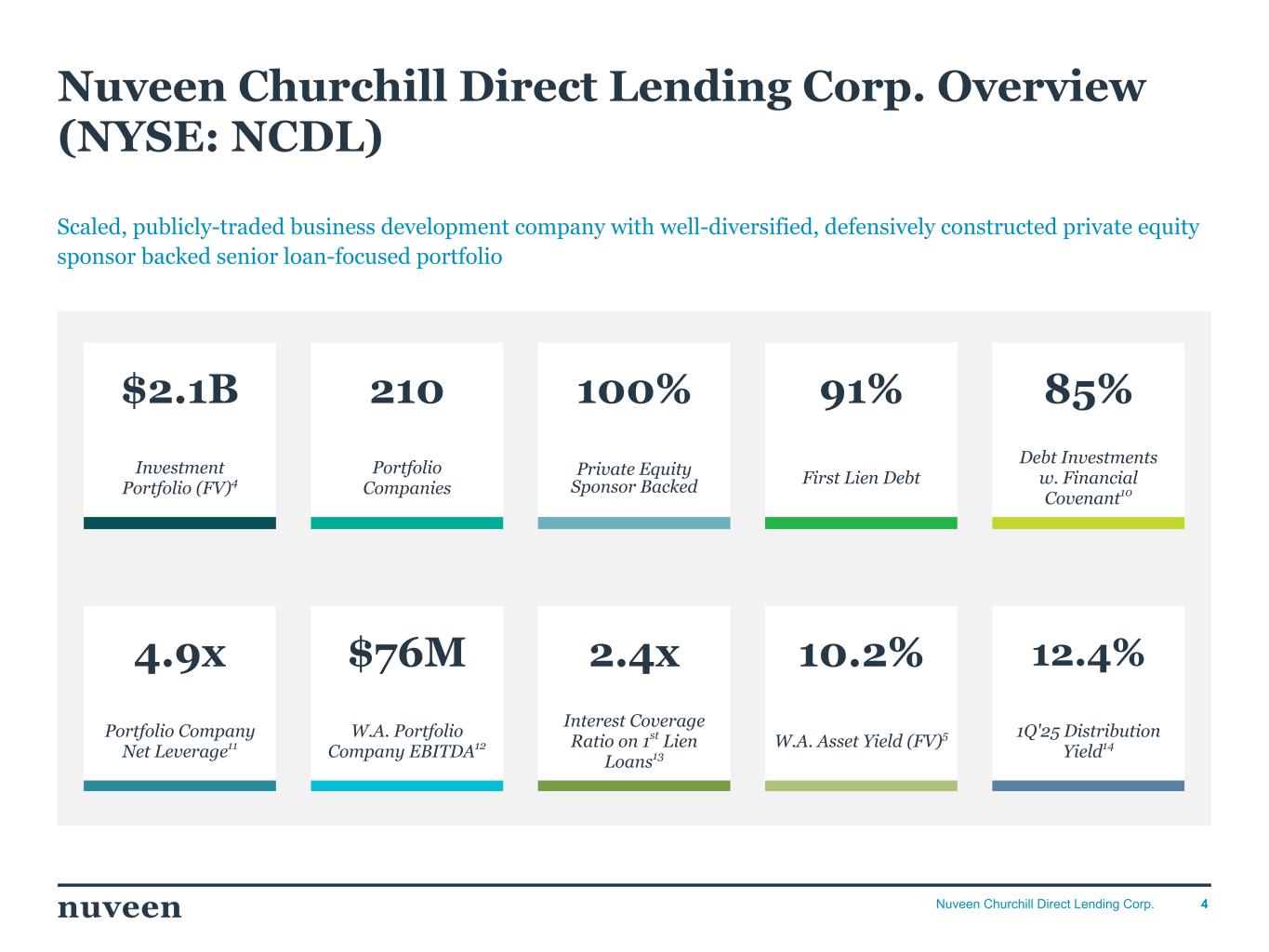

4Nuveen Churchill Direct Lending Corp. Nuveen Churchill Direct Lending Corp. Overview (NYSE: NCDL) Scaled, publicly-traded business development company with well-diversified, defensively constructed private equity sponsor backed senior loan-focused portfolio 4.9x $76M 2.4x 10.2% 12.4% Portfolio Company Net Leverage11 W.A. Portfolio Company EBITDA12 Interest Coverage Ratio on 1st Lien Loans13 W.A. Asset Yield (FV)5 1Q'25 Distribution Yield14 $2.1B 210 100% 91% 85% Investment Portfolio (FV)4 Portfolio Companies Private Equity Sponsor Backed First Lien Debt Debt Investments w. Financial Covenant10 EBITDA $76M (vs. $77M in PQ) • Immaterial increase from the PQ. • Refer to Gryphon Index in Q&A Interest Coverage 2.4x (2.1x) • Immaterial improvement from PQ • Consistent with overall portfolio WAVG Asset Yield FV 10.18% (PQ 10.41%) WAVG Asset Yield Cost 10.10% (PQ 10.33% ) • TMM spreads down ~ 15 bps • Rates down ~ 28 bps (Based on SOFR) • Entered 16 deals w/ WAVG Yield of 9.0% Distribution Yield 12.4% (12.0%) • Distribution decreased,slightly from PQ due to decline in NAV. Net Leverage 4.9x (4.9x) • Flat QovQ PQ for SV Reference

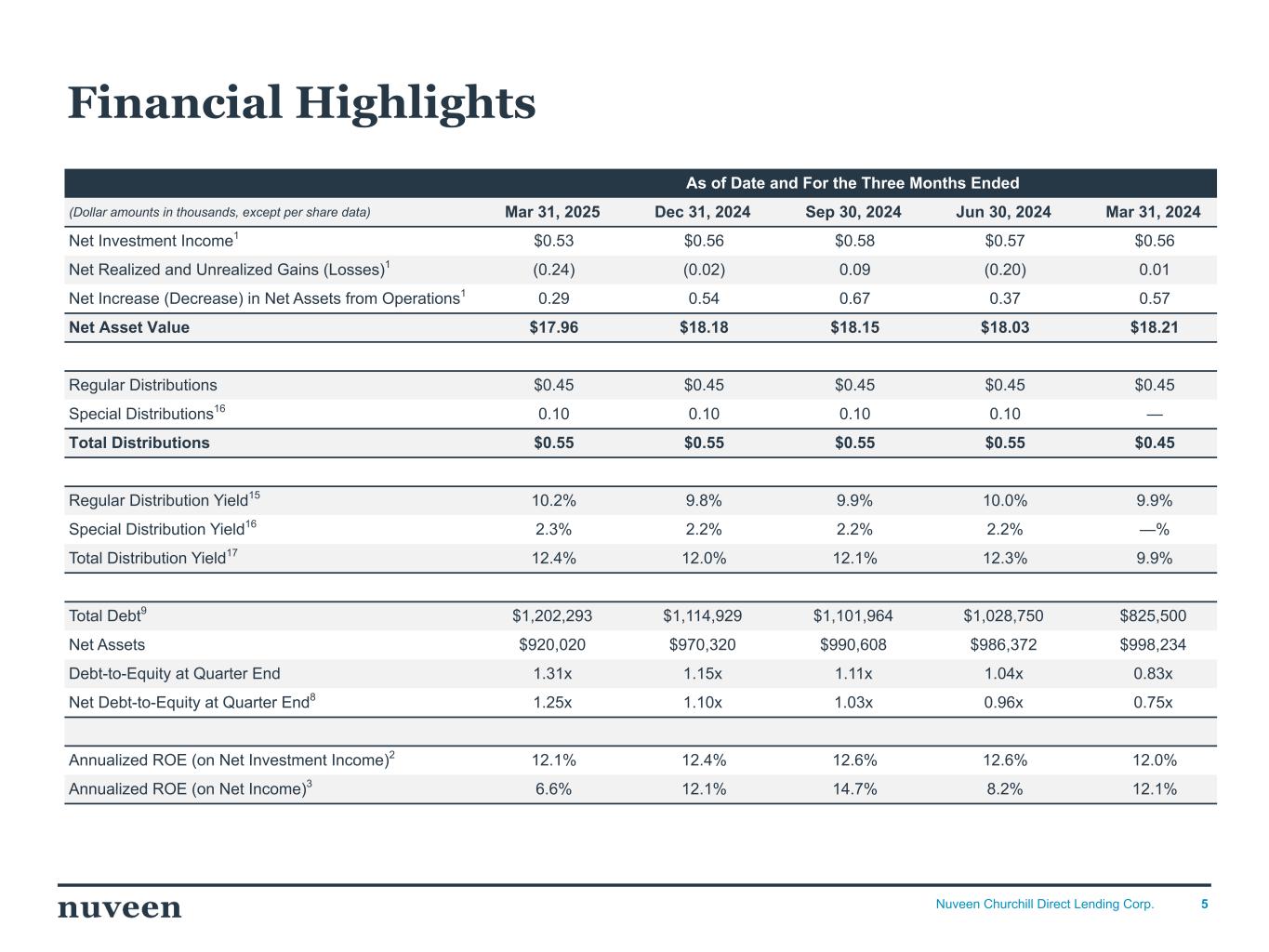

5Nuveen Churchill Direct Lending Corp. Financial Highlights As of Date and For the Three Months Ended (Dollar amounts in thousands, except per share data) Mar 31, 2025 Dec 31, 2024 Sep 30, 2024 Jun 30, 2024 Mar 31, 2024 Net Investment Income1 $0.53 $0.56 $0.58 $0.57 $0.56 Net Realized and Unrealized Gains (Losses)1 (0.24) (0.02) 0.09 (0.20) 0.01 Net Increase (Decrease) in Net Assets from Operations1 0.29 0.54 0.67 0.37 0.57 Net Asset Value $17.96 $18.18 $18.15 $18.03 $18.21 Regular Distributions $0.45 $0.45 $0.45 $0.45 $0.45 Special Distributions16 0.10 0.10 0.10 0.10 — Total Distributions $0.55 $0.55 $0.55 $0.55 $0.45 Regular Distribution Yield15 10.2% 9.8% 9.9% 10.0% 9.9% Special Distribution Yield16 2.3% 2.2% 2.2% 2.2% —% Total Distribution Yield17 12.4% 12.0% 12.1% 12.3% 9.9% Total Debt9 $1,202,293 $1,114,929 $1,101,964 $1,028,750 $825,500 Net Assets $920,020 $970,320 $990,608 $986,372 $998,234 Debt-to-Equity at Quarter End 1.31x 1.15x 1.11x 1.04x 0.83x Net Debt-to-Equity at Quarter End8 1.25x 1.10x 1.03x 0.96x 0.75x Annualized ROE (on Net Investment Income)2 12.1% 12.4% 12.6% 12.6% 12.0% Annualized ROE (on Net Income)3 6.6% 12.1% 14.7% 8.2% 12.1% Financial Highlights No additional talking point. Refer to Q1 Highlights slide for details PQ for SV Reference

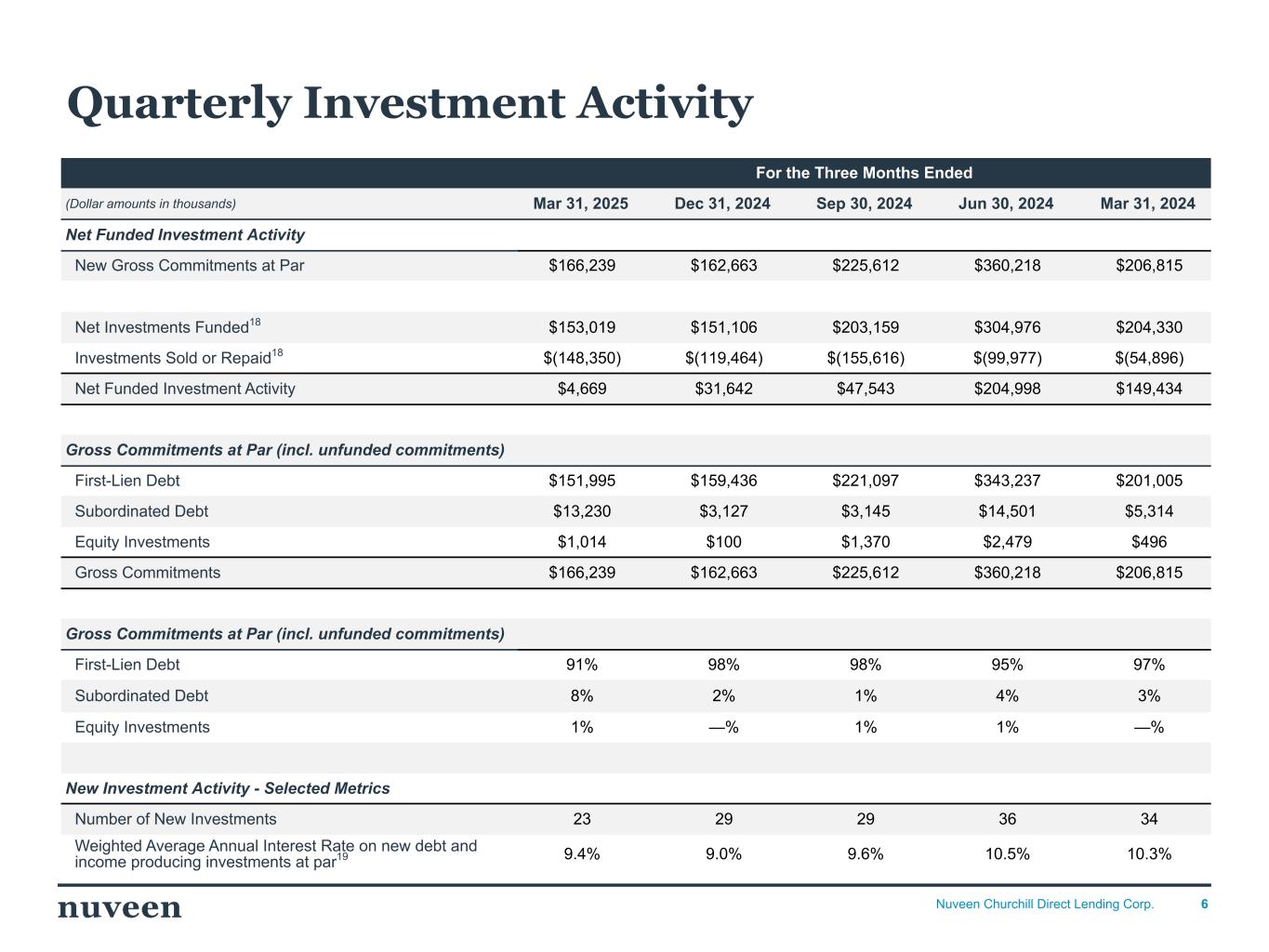

6Nuveen Churchill Direct Lending Corp. For the Three Months Ended (Dollar amounts in thousands) Mar 31, 2025 Dec 31, 2024 Sep 30, 2024 Jun 30, 2024 Mar 31, 2024 Net Funded Investment Activity New Gross Commitments at Par $166,239 $162,663 $225,612 $360,218 $206,815 Net Investments Funded18 $153,019 $151,106 $203,159 $304,976 $204,330 Investments Sold or Repaid18 $(148,350) $(119,464) $(155,616) $(99,977) $(54,896) Net Funded Investment Activity $4,669 $31,642 $47,543 $204,998 $149,434 Gross Commitments at Par (incl. unfunded commitments) First-Lien Debt $151,995 $159,436 $221,097 $343,237 $201,005 Subordinated Debt $13,230 $3,127 $3,145 $14,501 $5,314 Equity Investments $1,014 $100 $1,370 $2,479 $496 Gross Commitments $166,239 $162,663 $225,612 $360,218 $206,815 Gross Commitments at Par (incl. unfunded commitments) First-Lien Debt 91% 98% 98% 95% 97% Subordinated Debt 8% 2% 1% 4% 3% Equity Investments 1% —% 1% 1% —% New Investment Activity - Selected Metrics Number of New Investments 23 29 29 36 34 Weighted Average Annual Interest Rate on new debt and income producing investments at par19 9.4% 9.0% 9.6% 10.5% 10.3% Quarterly Investment Activity Net Funded Investment Activity New Gross Commitments at Par • Quarterly activity which includes par activity of: ◦ incrementals to existing portfolio companies ◦ originations of new portfolio companies Net Investments Funded • Reflects cash activity of: ◦ Incrementals to existing portfolio companies (30 million) ◦ Originations of new portfolio companies (91 million) ◦ Funding of follow on DDTL’s (30 million) ◦ Total: 151M Investments Sold or Repaid Reflects cash activity of: ◦ Sales (6.5 million) / Full Paydowns (78 million) ◦ Normal Paydowns (35 million) ◦ Total: 119.5 Net Funded (Funded + Sold/Repaid): ~32M New Investment Activity – Selected Metrics Number of New Investments is defined as Number of incremental deals & new origination deals Expected Weighted Average Interest Rate Population includes all new investments Calculation includes WAVG Par utilizing Spread + SOFR for floating & Coupon for fixed Does not incorporate OID TOTAL - 9.4% TMM - 9.15% UMM - 8.23% PEJC - 12.00% Other Stats UMM WAVG EBITDA - $237 M TMM WAVG EBITDA - $43 M

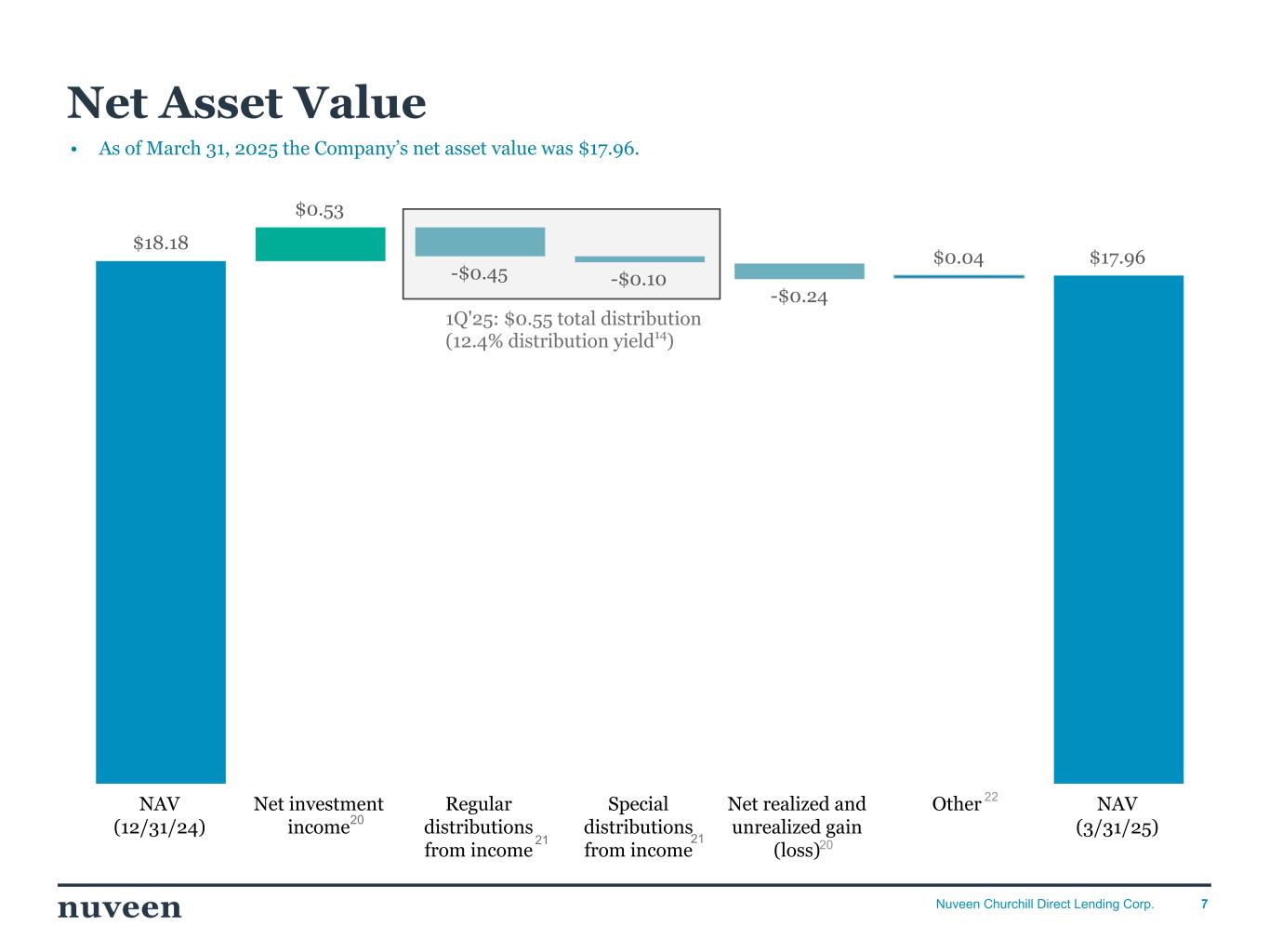

7Nuveen Churchill Direct Lending Corp. • As of March 31, 2025 the Company’s net asset value was $17.96. $18.18 $0.53 -$0.45 -$0.10 -$0.24 $0.04 $17.96 NAV (12/31/24) Net investment income Regular distributions from income Special distributions from income Net realized and unrealized gain (loss) Other NAV (3/31/25) Net Asset Value 21 20 1Q'25: $0.55 total distribution (12.4% distribution yield14) 2021 22 Net Investment Income Per Share (Net Investment Income Per Share ($0.53) • Calculated based on WAVG shares outstanding throughout quarter • Investment Income decreased ~ (5) percent QovQ ◦ WAVG Yield, at Cost, decreased to 10.2% from 10.9% QovQ. ◦ Investment Balance increased to $2.1B O/S from $2.0B O/S • Expenses decrease by ~ 4% QoQ Regular distribution Per Share ($0.45) • Target distribution of $0.45 hit • Held back of $0.11 of NII • Undistributed spillover distributable taxable income of ~ $.30 Net realized and unrealized per share ($.09) • Notable U/R Gains ◦ Anne Arundel $.01 ◦ Seko $.02 • Realized Gains ◦ Random paydowns/Sales $.02 NAV Per Share ($17.96) • Calculated based on shares outstanding as of quarter-end • Increase due to benefits of share repurchase program that showed significant activity in Q4 (1.3M share) Annual ROE on NII (12.1%) Annual ROE on NI (6.6%) • Calculated based on shares outstanding as of 03/31 PQ for SV Reference

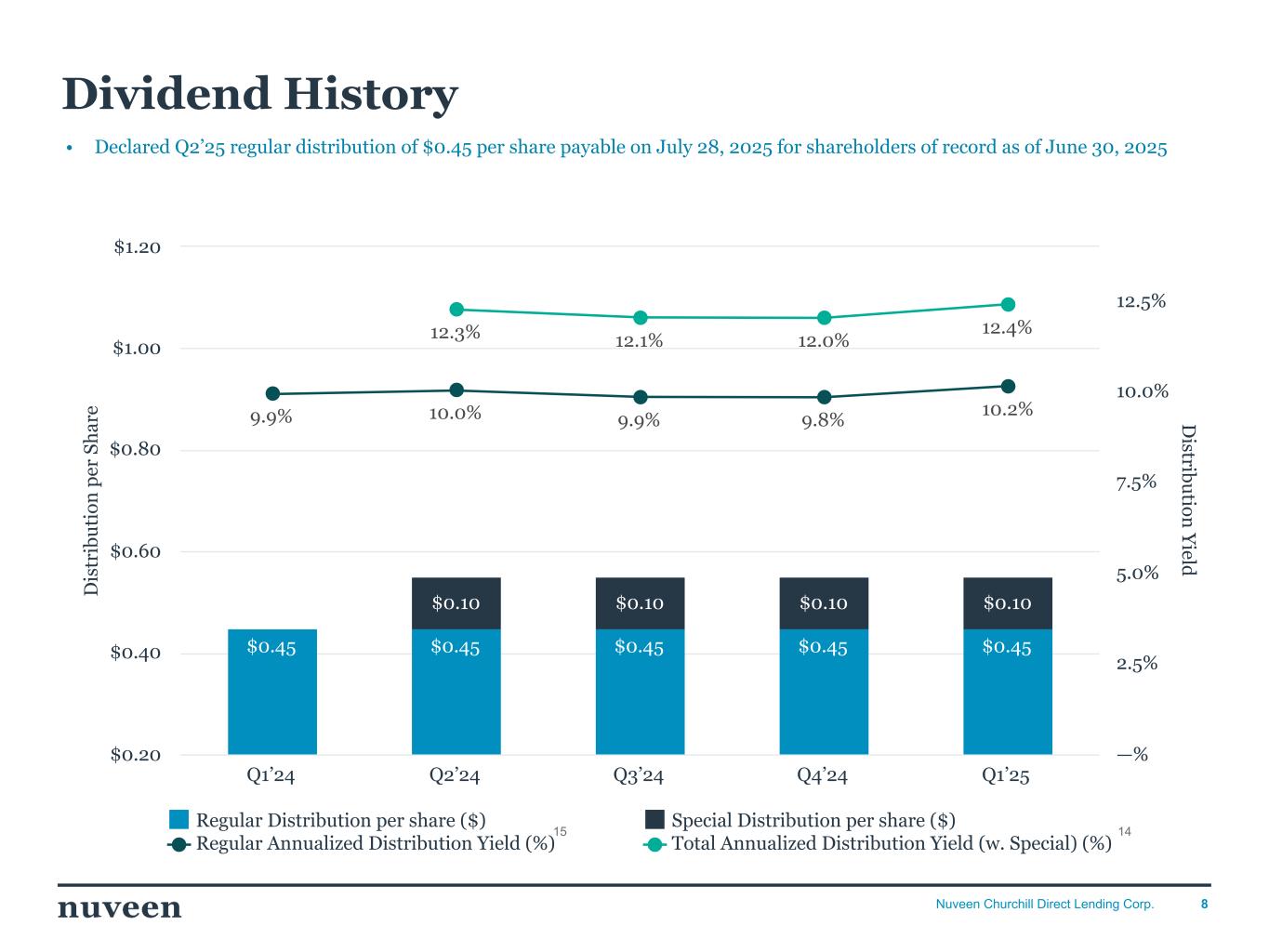

8Nuveen Churchill Direct Lending Corp. • Declared Q2’25 regular distribution of $0.45 per share payable on July 28, 2025 for shareholders of record as of June 30, 2025 Dividend History D is tr ib u ti on p er S h ar e D istribu tion Y ield $0.45 $0.45 $0.45 $0.45 $0.45 $0.10 $0.10 $0.10 $0.10 9.9% 10.0% 9.9% 9.8% 10.2% 12.3% 12.1% 12.0% 12.4% Regular Distribution per share ($) Special Distribution per share ($) Regular Annualized Distribution Yield (%) Total Annualized Distribution Yield (w. Special) (%) Q1’24 Q2’24 Q3’24 Q4’24 Q1’25 $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 —% 2.5% 5.0% 7.5% 10.0% 12.5% 15 14 General • Consistent $.55 dist. from ’24 Q4 – ’23 Q4 in-line with IPO plan • Yield flat in-line with scheduled special distributions are factored into Dividend Yield. PQ for SV Reference

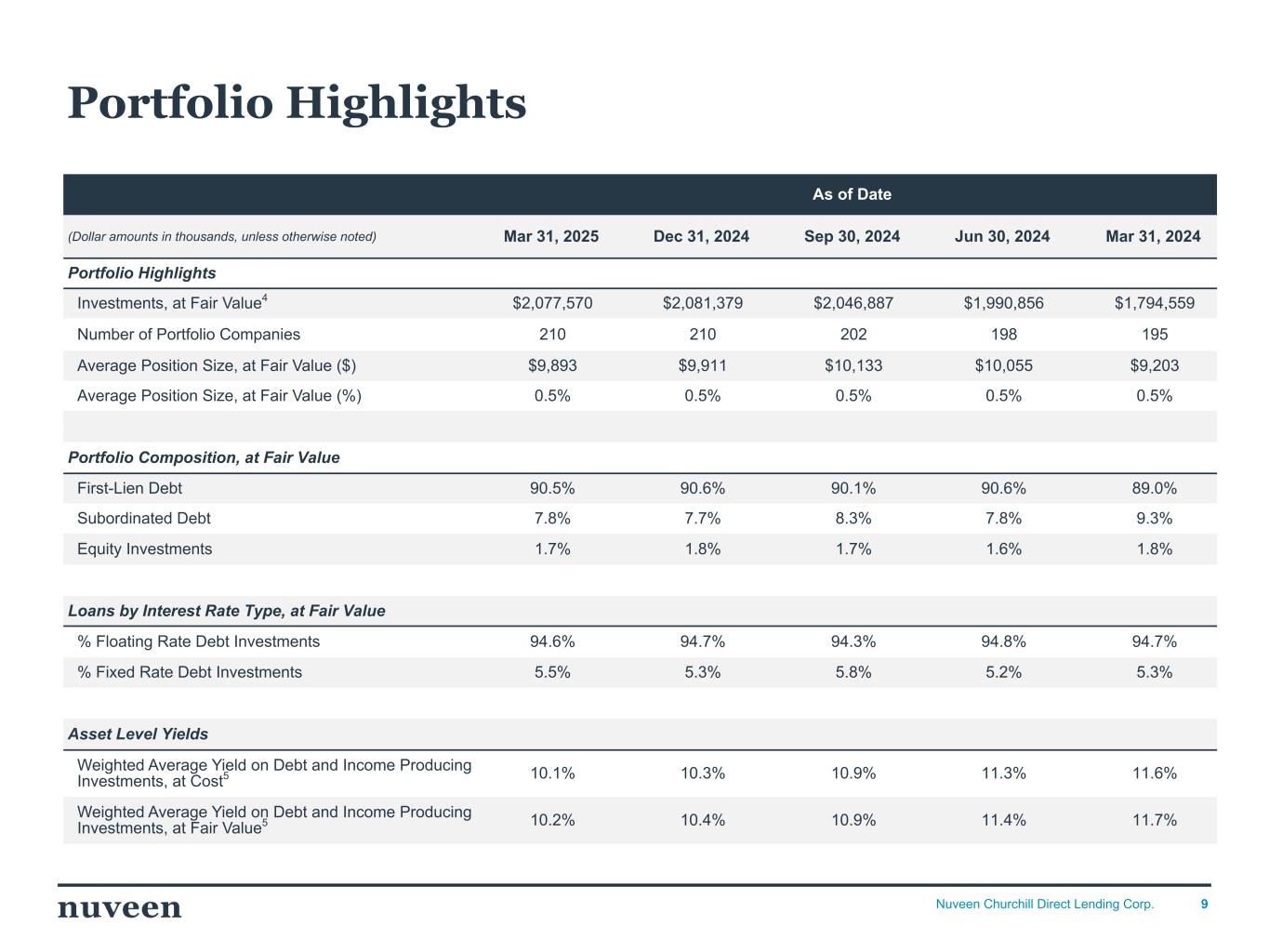

9Nuveen Churchill Direct Lending Corp. As of Date (Dollar amounts in thousands, unless otherwise noted) Mar 31, 2025 Dec 31, 2024 Sep 30, 2024 Jun 30, 2024 Mar 31, 2024 Portfolio Highlights Investments, at Fair Value4 $2,077,570 $2,081,379 $2,046,887 $1,990,856 $1,794,559 Number of Portfolio Companies 210 210 202 198 195 Average Position Size, at Fair Value ($) $9,893 $9,911 $10,133 $10,055 $9,203 Average Position Size, at Fair Value (%) 0.5% 0.5% 0.5% 0.5% 0.5% Portfolio Composition, at Fair Value First-Lien Debt 90.5% 90.6% 90.1% 90.6% 89.0% Subordinated Debt 7.8% 7.7% 8.3% 7.8% 9.3% Equity Investments 1.7% 1.8% 1.7% 1.6% 1.8% Loans by Interest Rate Type, at Fair Value % Floating Rate Debt Investments 94.6% 94.7% 94.3% 94.8% 94.7% % Fixed Rate Debt Investments 5.5% 5.3% 5.8% 5.2% 5.3% Asset Level Yields Weighted Average Yield on Debt and Income Producing Investments, at Cost5 10.1% 10.3% 10.9% 11.3% 11.6% Weighted Average Yield on Debt and Income Producing Investments, at Fair Value5 10.2% 10.4% 10.9% 11.4% 11.7% Portfolio Highlights Portfolio Highlights • Investment fair value increased by $35M ◦ Refer to the activity summarized on Quarterly Investment Activity ◦ MtoM WAVG Valuation increased by 11 bps. • Number of Port Co. increased by 8 ◦ 16 purchases ◦ 8 paydowns/sales Portfolio Composition • Breakdown based on fair value • Increase in First-Lien Term Loans due to greater investment activity, as MtoM WAVG Valuation increased by 12 bps • Decrease in Subordinate Debt due to lesser investment activity, as MtoM WAVG Valuation increased by 8 bps Loans by Interest Rate Types • Floating Rate Debt Investments increased ~5 bps from PQ ◦ Increase to factors noted above Asset Level Yields • Decrease driven by tightening SOFR rates of 28 bps and slight decline in spreads QovQ.

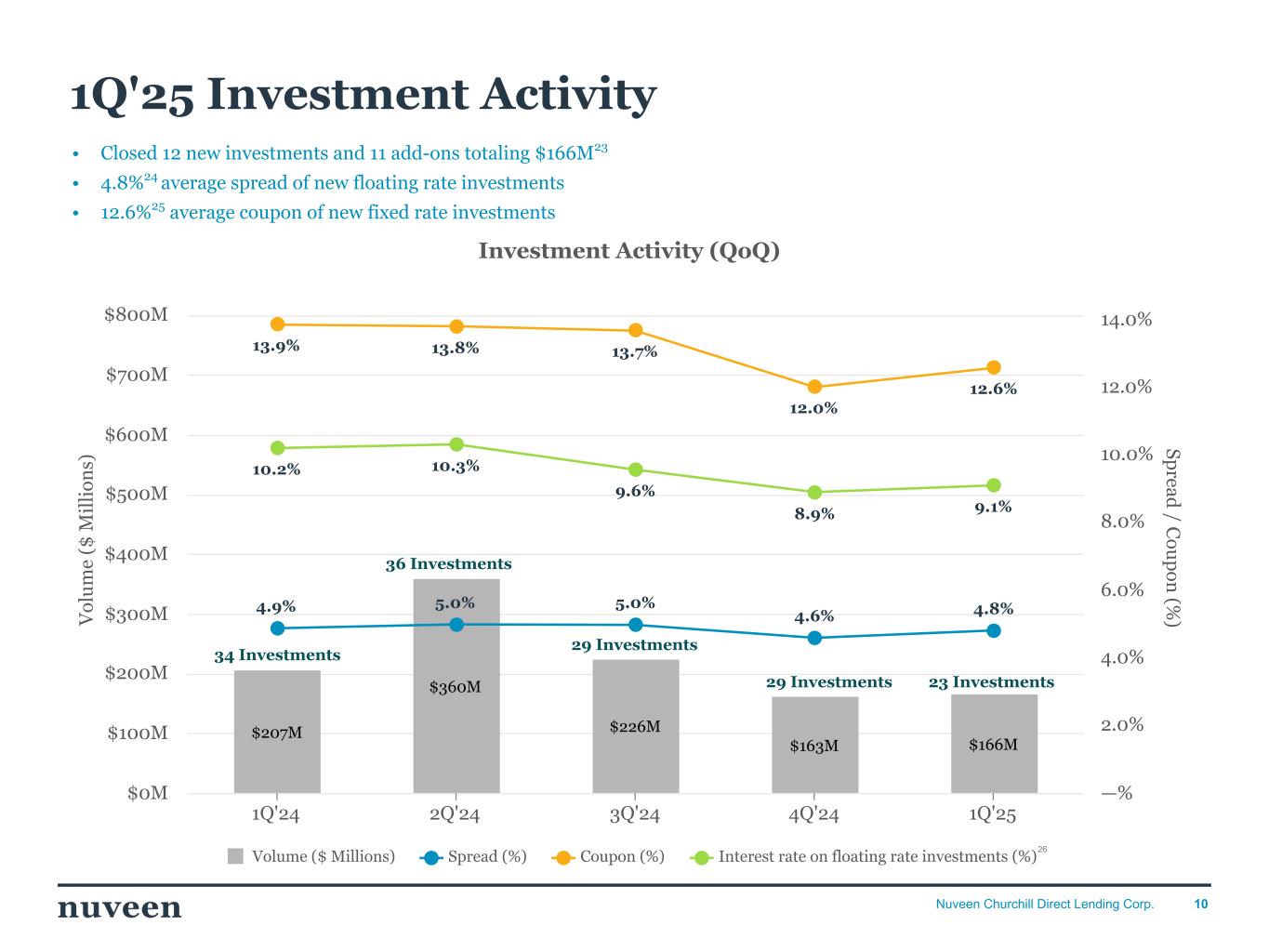

10Nuveen Churchill Direct Lending Corp. V ol u m e ($ M il li on s) Sp read / C ou p on (% ) Investment Activity (QoQ) $207M $360M $226M $163M $166M 4.9% 5.0% 5.0% 4.6% 4.8% 13.9% 13.8% 13.7% 12.0% 12.6% 10.2% 10.3% 9.6% 8.9% 9.1% Volume ($ Millions) Spread (%) Coupon (%) Interest rate on floating rate investments (%) 1Q'24 2Q'24 3Q'24 4Q'24 1Q'25 $0M $100M $200M $300M $400M $500M $600M $700M $800M —% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% • Closed 12 new investments and 11 add-ons totaling $166M23 • 4.8%24 average spread of new floating rate investments • 12.6%25 average coupon of new fixed rate investments 1Q'25 Investment Activity 36 Investments 26 29 Investments 29 Investments 34 Investments 23 Investments General • Refer to Quarterly Investment Activity (slide 6)

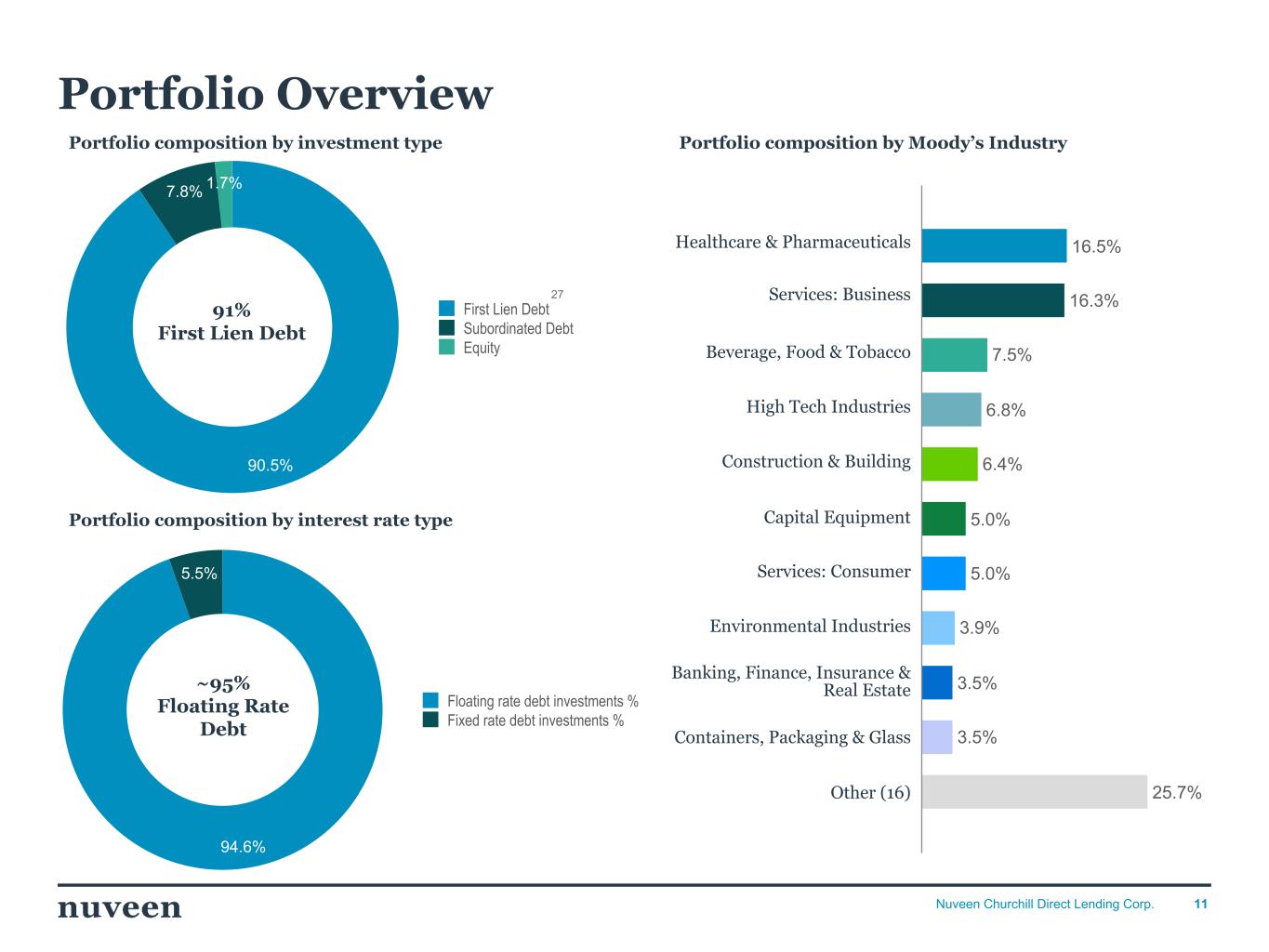

11Nuveen Churchill Direct Lending Corp. 94.6% 5.5% Floating rate debt investments % Fixed rate debt investments % 90.5% 7.8% 1.7% First Lien Debt Subordinated Debt Equity 91% First Lien Debt Portfolio Overview Portfolio composition by investment type Portfolio composition by interest rate type ~95% Floating Rate Debt 16.5% 16.3% 7.5% 6.8% 6.4% 5.0% 5.0% 3.9% 3.5% 3.5% 25.7% Portfolio composition by Moody’s Industry Healthcare & Pharmaceuticals Services: Business Beverage, Food & Tobacco High Tech Industries Construction & Building Capital Equipment Services: Consumer Environmental Industries Banking, Finance, Insurance & Real Estate Containers, Packaging & Glass Other (16) 27 Portfolio Overview • Industries experiencing most weakness continue to be Healthcare (Anne Arundel, Affinity Hospice, Genesee Scientific, Smile Brands) & Transportation Cargo (SEKO) • Other industries are generally flat and hover around ~ $98 - ~ $99. • One new Moody’s industry during the quarter Hotel Gaming & Leisure - 1 name 0.15% of FV PQ for SV Reference

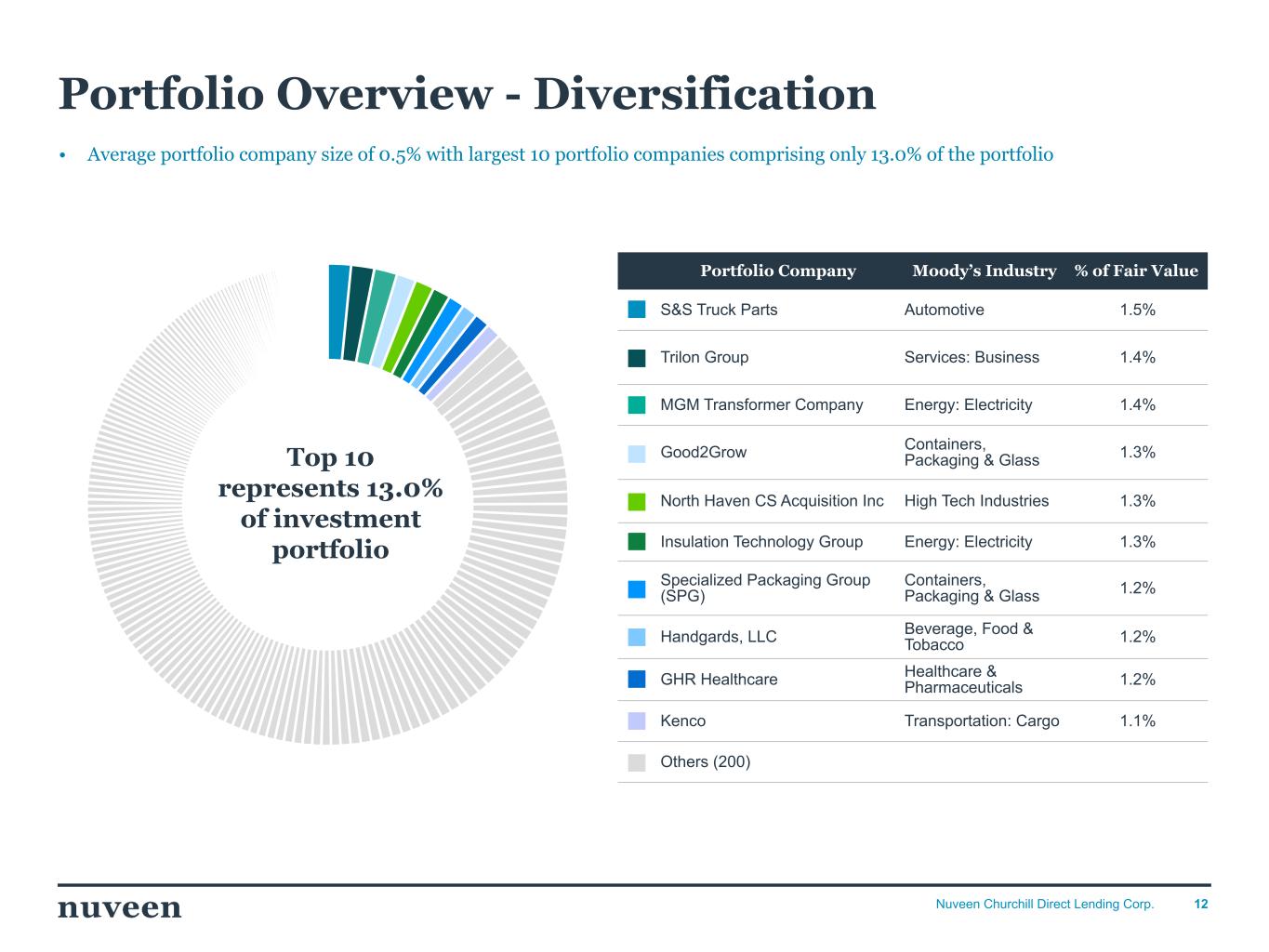

12Nuveen Churchill Direct Lending Corp. Portfolio Overview - Diversification Top 10 represents 13.0% of investment portfolio Portfolio Company Moody’s Industry % of Fair Value S&S Truck Parts Automotive 1.5% Trilon Group Services: Business 1.4% MGM Transformer Company Energy: Electricity 1.4% Good2Grow Containers, Packaging & Glass 1.3% North Haven CS Acquisition Inc High Tech Industries 1.3% Insulation Technology Group Energy: Electricity 1.3% Specialized Packaging Group (SPG) Containers, Packaging & Glass 1.2% Handgards, LLC Beverage, Food & Tobacco 1.2% GHR Healthcare Healthcare & Pharmaceuticals 1.2% Kenco Transportation: Cargo 1.1% Others (200) • Average portfolio company size of 0.5% with largest 10 portfolio companies comprising only 13.0% of the portfolio Portfolio Overview - Diversification • Portfolio well diversified with largest portfolios only at 1.5% • Top 10 Names at fair value comprise 13.0% vs PQ 14.1% ◦ Decrease driven by full Paydown of Rise Baking (3rd largest Portfolio Company by FV PQ) PQ for SV Reference

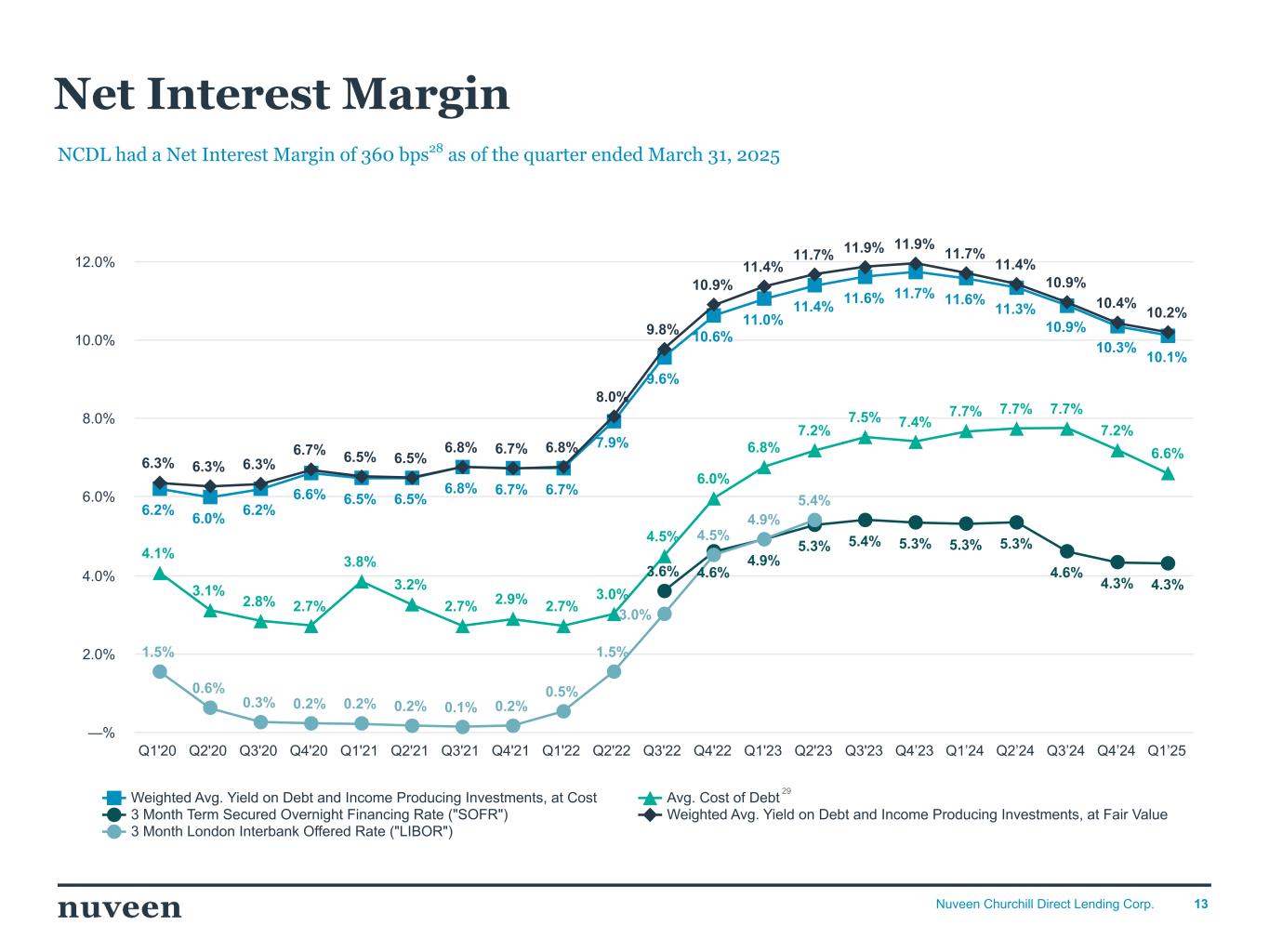

13Nuveen Churchill Direct Lending Corp. NCDL had a Net Interest Margin of 360 bps28 as of the quarter ended March 31, 2025 Net Interest Margin 6.2% 6.0% 6.2% 6.6% 6.5% 6.5% 6.8% 6.7% 6.7% 7.9% 9.6% 10.6% 11.0% 11.4% 11.6% 11.7% 11.6% 11.3% 10.9% 10.3% 10.1% 4.1% 3.1% 2.8% 2.7% 3.8% 3.2% 2.7% 2.9% 2.7% 3.0% 4.5% 6.0% 6.8% 7.2% 7.5% 7.4% 7.7% 7.7% 7.7% 7.2% 6.6% 3.6% 4.6% 4.9% 5.3% 5.4% 5.3% 5.3% 5.3% 4.6% 4.3% 4.3% 6.3% 6.3% 6.3% 6.7% 6.5% 6.5% 6.8% 6.7% 6.8% 8.0% 9.8% 10.9% 11.4% 11.7% 11.9% 11.9% 11.7% 11.4% 10.9% 10.4% 10.2% 1.5% 0.6% 0.3% 0.2% 0.2% 0.2% 0.1% 0.2% 0.5% 1.5% 3.0% 4.5% 4.9% 5.4% Weighted Avg. Yield on Debt and Income Producing Investments, at Cost Avg. Cost of Debt 3 Month Term Secured Overnight Financing Rate ("SOFR") Weighted Avg. Yield on Debt and Income Producing Investments, at Fair Value 3 Month London Interbank Offered Rate ("LIBOR") Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4’23 Q1’24 Q2’24 Q3’24 Q4’24 Q1’25 —% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 29 Net Interest Margin • NIM shows good story as gap between Yield & Avg. Cost of Debt has expanded by multiples since inception, however tempered in recent quarter. • Current quarter trend is in-line with expectations

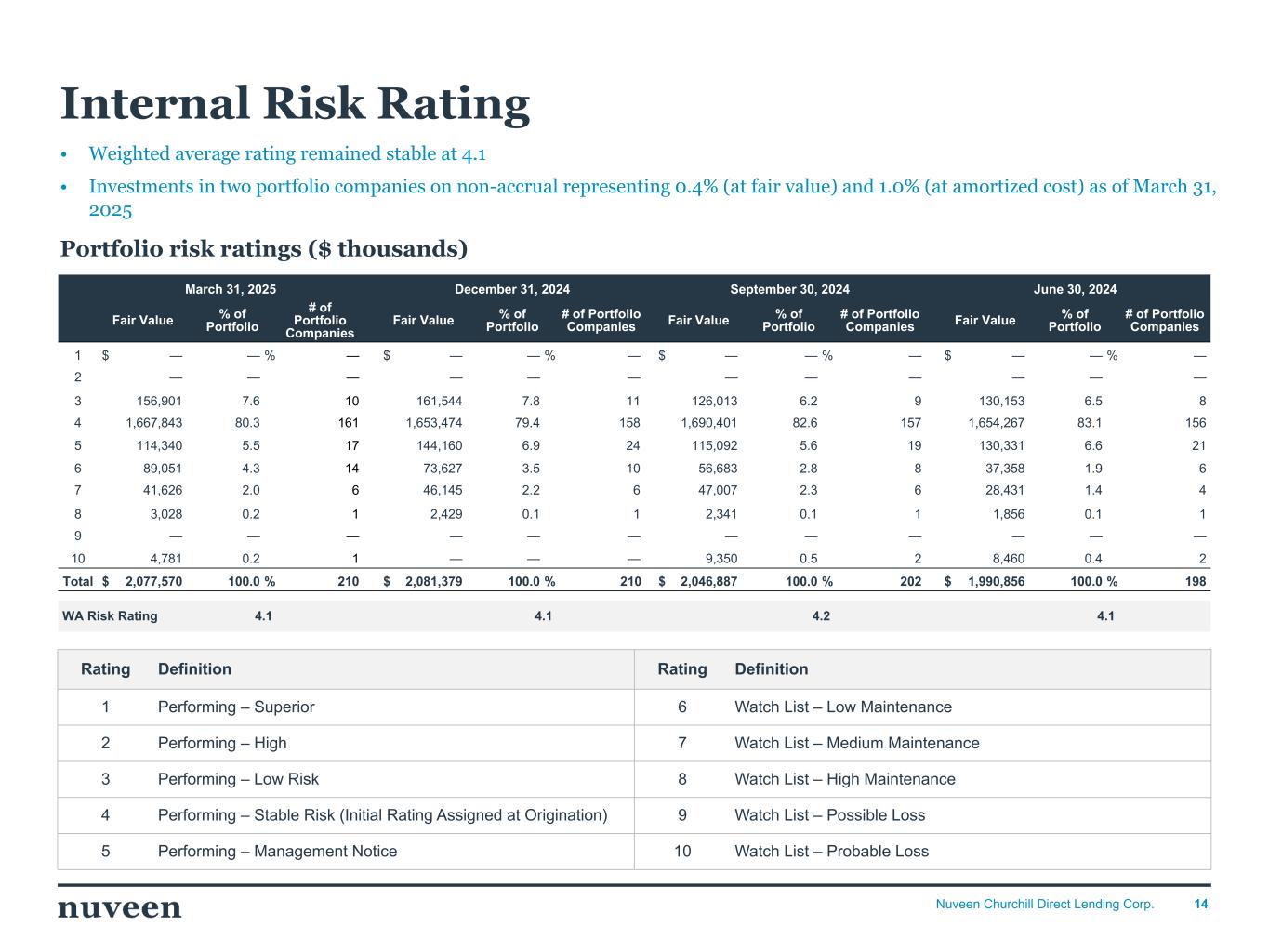

14Nuveen Churchill Direct Lending Corp. Internal Risk Rating Portfolio risk ratings ($ thousands) Rating Definition Rating Definition 1 Performing – Superior 6 Watch List – Low Maintenance 2 Performing – High 7 Watch List – Medium Maintenance 3 Performing – Low Risk 8 Watch List – High Maintenance 4 Performing – Stable Risk (Initial Rating Assigned at Origination) 9 Watch List – Possible Loss 5 Performing – Management Notice 10 Watch List – Probable Loss • Weighted average rating remained stable at 4.1 • Investments in two portfolio companies on non-accrual representing 0.4% (at fair value) and 1.0% (at amortized cost) as of March 31, 2025 March 31, 2025 December 31, 2024 September 30, 2024 June 30, 2024 Fair Value % of Portfolio # of Portfolio Companies Fair Value % of Portfolio # of Portfolio Companies Fair Value % of Portfolio # of Portfolio Companies Fair Value % of Portfolio # of Portfolio Companies 1 $ — — % — $ — — % — $ — — % — $ — — % — 2 — — — — — — — — — — — — 3 156,901 7.6 10 161,544 7.8 11 126,013 6.2 9 130,153 6.5 8 4 1,667,843 80.3 161 1,653,474 79.4 158 1,690,401 82.6 157 1,654,267 83.1 156 5 114,340 5.5 17 144,160 6.9 24 115,092 5.6 19 130,331 6.6 21 6 89,051 4.3 14 73,627 3.5 10 56,683 2.8 8 37,358 1.9 6 7 41,626 2.0 6 46,145 2.2 6 47,007 2.3 6 28,431 1.4 4 8 3,028 0.2 1 2,429 0.1 1 2,341 0.1 1 1,856 0.1 1 9 — — — — — — — — — — — — 10 4,781 0.2 1 — — — 9,350 0.5 2 8,460 0.4 2 Total $ 2,077,570 100.0 % 210 $ 2,081,379 100.0 % 210 $ 2,046,887 100.0 % 202 $ 1,990,856 100.0 % 198 WA Risk Rating 4.1 4.1 4.2 4.1 Internal Risk Rating • Anne Arundel is an 8 on non- accrual, a/o 3/31 • JEGS & SEKO are 6’s and put back on accrual, a/o 12/31 • 2 addition to the watchlist ◦ Scaled Agile – 6 (5) ◦ Covercraft – 6 (5) • 2 removals from watchlist ◦ Repipe – 5 (6) ◦ One World Fitness – 5 (6) • Total Watchlist names represent 5.9% of the fair value of the portfolio compared to 5.6% in the prior quarter

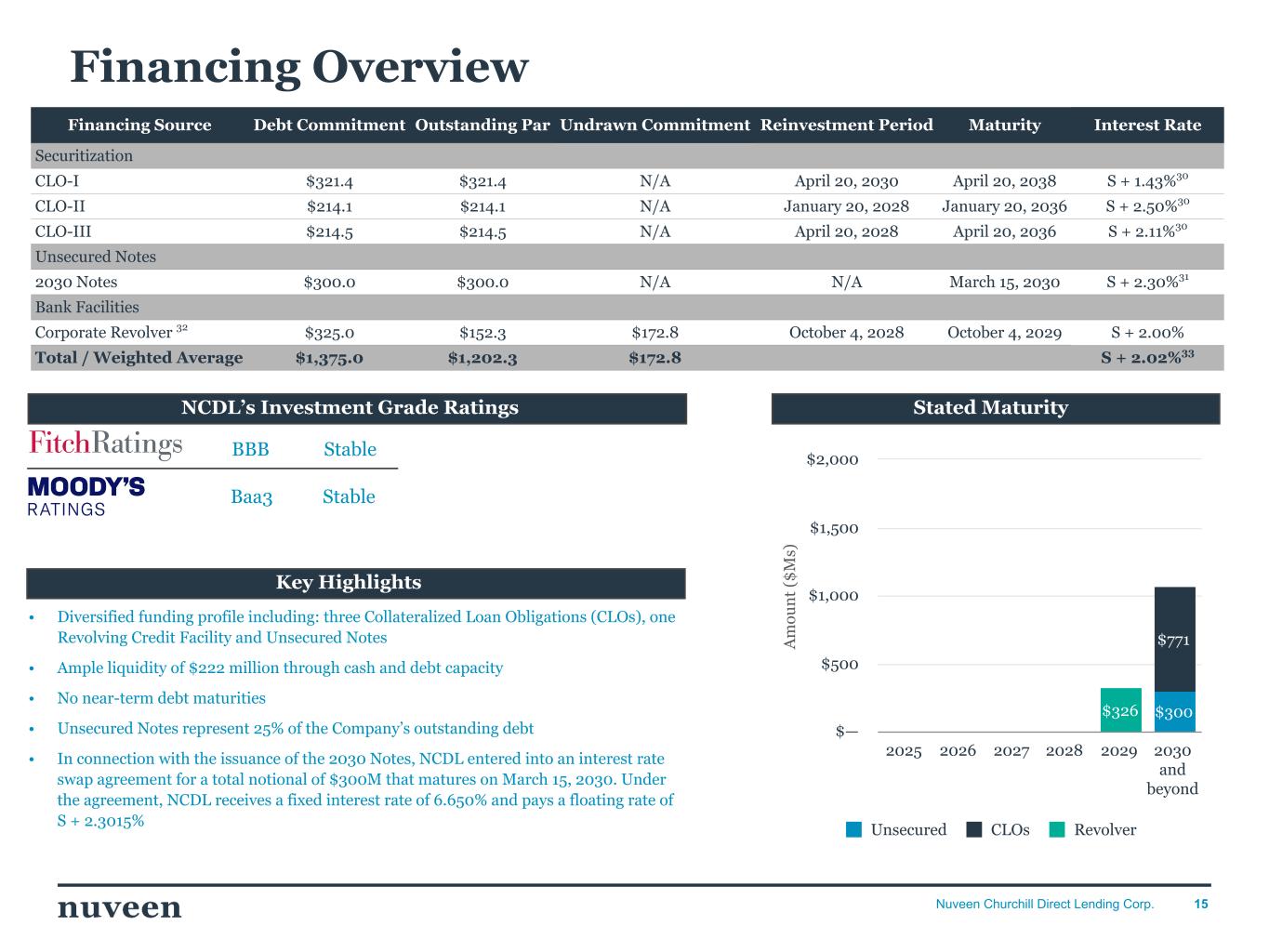

15Nuveen Churchill Direct Lending Corp. • Diversified funding profile including: three Collateralized Loan Obligations (CLOs), one Revolving Credit Facility and Unsecured Notes • Ample liquidity of $222 million through cash and debt capacity • No near-term debt maturities • Unsecured Notes represent 25% of the Company’s outstanding debt • In connection with the issuance of the 2030 Notes, NCDL entered into an interest rate swap agreement for a total notional of $300M that matures on March 15, 2030. Under the agreement, NCDL receives a fixed interest rate of 6.650% and pays a floating rate of S + 2.3015% Financing Overview A m ou n t ($ M s) $300 $771 $326 Unsecured CLOs Revolver 2025 2026 2027 2028 2029 2030 and beyond $— $500 $1,000 $1,500 $2,000 Financing Overview • General ◦ Debt increased QovQ from PQ $1,094 to $1,202.3 driven by the Paydown of the SMBC Financing Facility and increase to the Corp. Revolver • Corporate Revolver ◦ Drawn increased from $113M to $152.3 • WF Financing Facility ◦ Drawn increased from $95M to $300.0 Per BL - Roadshow.IPO discussion: 30%-35% Secured Financing Total Capitalization 20-25% unsecured 45% Equity As of 25Q1 – 22% Unsecured Funded – 25% Unsecured Outstanding Target - at least 1/3 of Debt unsecured PQ for SV Reference Key Highlights NCDL’s Investment Grade Ratings Stated Maturity BBB Stable Baa3 Stable Financing Source Debt Commitment Outstanding Par Undrawn Commitment Reinvestment Period Maturity Interest Rate Securitization CLO-I $321.4 $321.4 N/A April 20, 2030 April 20, 2038 S + 1.43%30 CLO-II $214.1 $214.1 N/A January 20, 2028 January 20, 2036 S + 2.50%30 CLO-III $214.5 $214.5 N/A April 20, 2028 April 20, 2036 S + 2.11%30 Unsecured Notes 2030 Notes $300.0 $300.0 N/A N/A March 15, 2030 S + 2.30%31 Bank Facilities Corporate Revolver 32 $325.0 $152.3 $172.8 October 4, 2028 October 4, 2029 S + 2.00% Total / Weighted Average $1,375.0 $1,202.3 $172.8 S + 2.02%33

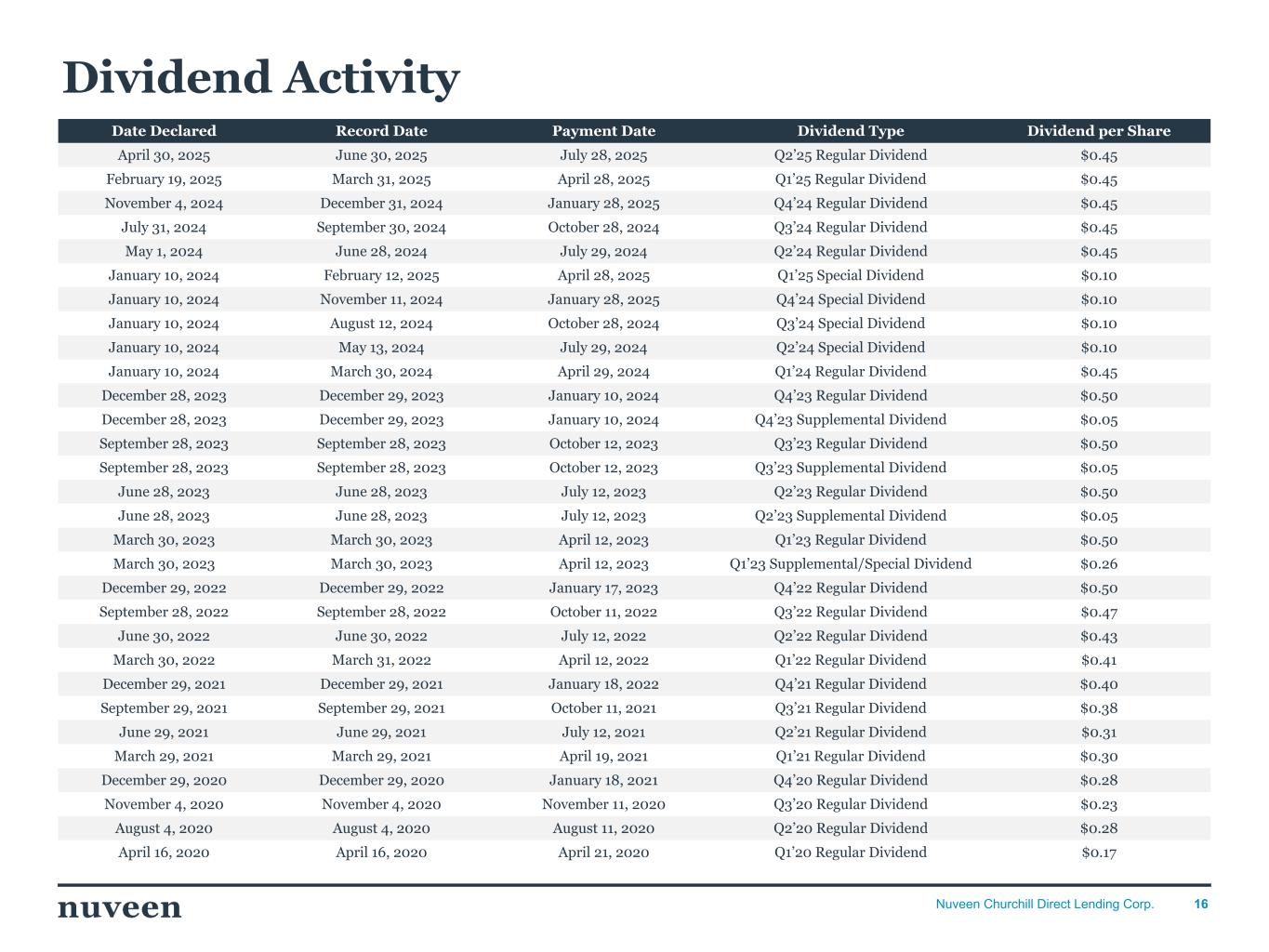

16Nuveen Churchill Direct Lending Corp. Dividend Activity Date Declared Record Date Payment Date Dividend Type Dividend per Share April 30, 2025 June 30, 2025 July 28, 2025 Q2’25 Regular Dividend $0.45 February 19, 2025 March 31, 2025 April 28, 2025 Q1’25 Regular Dividend $0.45 November 4, 2024 December 31, 2024 January 28, 2025 Q4’24 Regular Dividend $0.45 July 31, 2024 September 30, 2024 October 28, 2024 Q3’24 Regular Dividend $0.45 May 1, 2024 June 28, 2024 July 29, 2024 Q2’24 Regular Dividend $0.45 January 10, 2024 February 12, 2025 April 28, 2025 Q1’25 Special Dividend $0.10 January 10, 2024 November 11, 2024 January 28, 2025 Q4’24 Special Dividend $0.10 January 10, 2024 August 12, 2024 October 28, 2024 Q3’24 Special Dividend $0.10 January 10, 2024 May 13, 2024 July 29, 2024 Q2’24 Special Dividend $0.10 January 10, 2024 March 30, 2024 April 29, 2024 Q1’24 Regular Dividend $0.45 December 28, 2023 December 29, 2023 January 10, 2024 Q4’23 Regular Dividend $0.50 December 28, 2023 December 29, 2023 January 10, 2024 Q4’23 Supplemental Dividend $0.05 September 28, 2023 September 28, 2023 October 12, 2023 Q3’23 Regular Dividend $0.50 September 28, 2023 September 28, 2023 October 12, 2023 Q3’23 Supplemental Dividend $0.05 June 28, 2023 June 28, 2023 July 12, 2023 Q2’23 Regular Dividend $0.50 June 28, 2023 June 28, 2023 July 12, 2023 Q2’23 Supplemental Dividend $0.05 March 30, 2023 March 30, 2023 April 12, 2023 Q1’23 Regular Dividend $0.50 March 30, 2023 March 30, 2023 April 12, 2023 Q1’23 Supplemental/Special Dividend $0.26 December 29, 2022 December 29, 2022 January 17, 2023 Q4’22 Regular Dividend $0.50 September 28, 2022 September 28, 2022 October 11, 2022 Q3’22 Regular Dividend $0.47 June 30, 2022 June 30, 2022 July 12, 2022 Q2’22 Regular Dividend $0.43 March 30, 2022 March 31, 2022 April 12, 2022 Q1’22 Regular Dividend $0.41 December 29, 2021 December 29, 2021 January 18, 2022 Q4’21 Regular Dividend $0.40 September 29, 2021 September 29, 2021 October 11, 2021 Q3’21 Regular Dividend $0.38 June 29, 2021 June 29, 2021 July 12, 2021 Q2’21 Regular Dividend $0.31 March 29, 2021 March 29, 2021 April 19, 2021 Q1’21 Regular Dividend $0.30 December 29, 2020 December 29, 2020 January 18, 2021 Q4’20 Regular Dividend $0.28 November 4, 2020 November 4, 2020 November 11, 2020 Q3’20 Regular Dividend $0.23 August 4, 2020 August 4, 2020 August 11, 2020 Q2’20 Regular Dividend $0.28 April 16, 2020 April 16, 2020 April 21, 2020 Q1’20 Regular Dividend $0.17

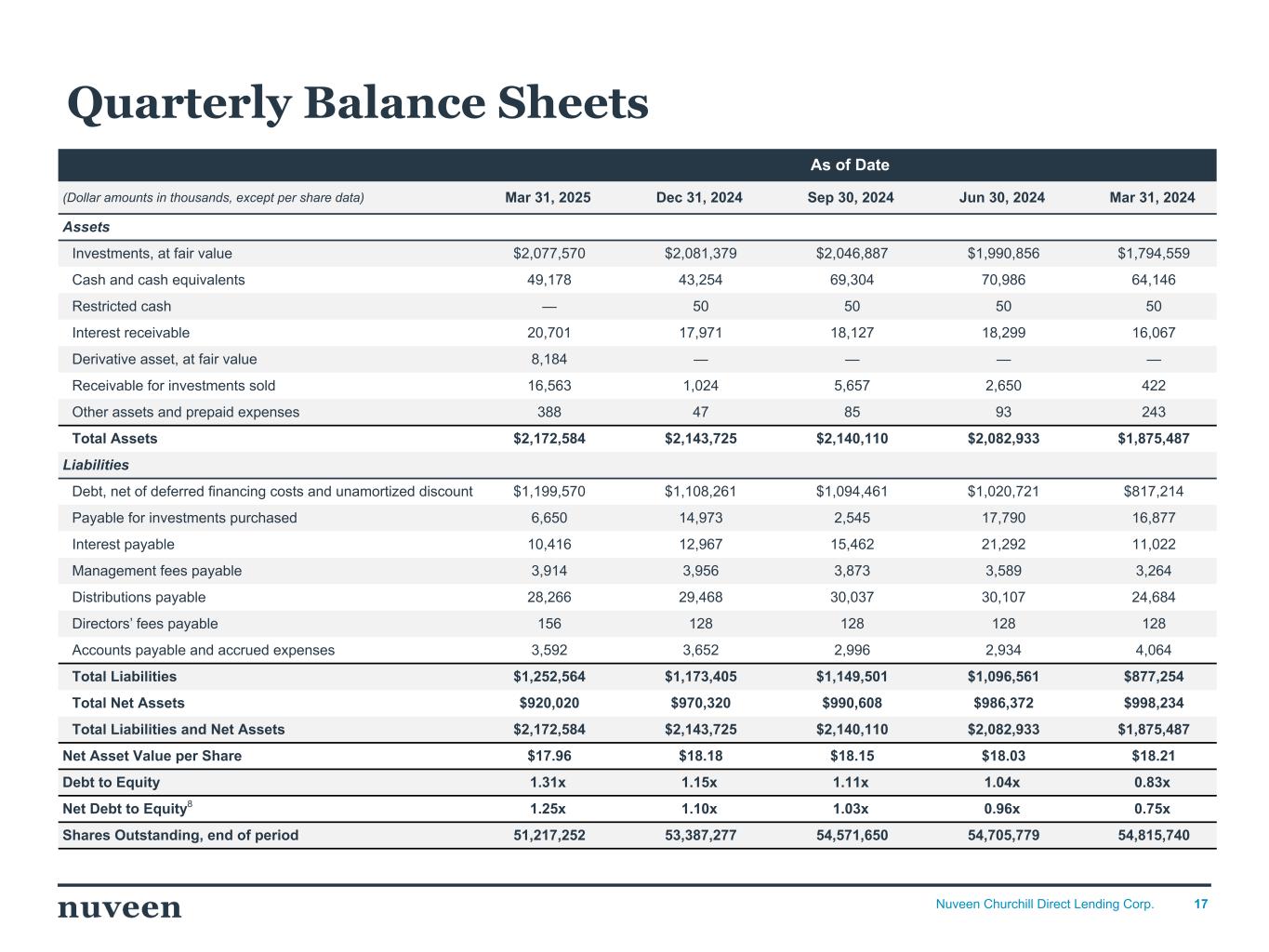

17Nuveen Churchill Direct Lending Corp. As of Date (Dollar amounts in thousands, except per share data) Mar 31, 2025 Dec 31, 2024 Sep 30, 2024 Jun 30, 2024 Mar 31, 2024 Assets Investments, at fair value $2,077,570 $2,081,379 $2,046,887 $1,990,856 $1,794,559 Cash and cash equivalents 49,178 43,254 69,304 70,986 64,146 Restricted cash — 50 50 50 50 Interest receivable 20,701 17,971 18,127 18,299 16,067 Derivative asset, at fair value 8,184 — — — — Receivable for investments sold 16,563 1,024 5,657 2,650 422 Other assets and prepaid expenses 388 47 85 93 243 Total Assets $2,172,584 $2,143,725 $2,140,110 $2,082,933 $1,875,487 Liabilities Debt, net of deferred financing costs and unamortized discount $1,199,570 $1,108,261 $1,094,461 $1,020,721 $817,214 Payable for investments purchased 6,650 14,973 2,545 17,790 16,877 Interest payable 10,416 12,967 15,462 21,292 11,022 Management fees payable 3,914 3,956 3,873 3,589 3,264 Distributions payable 28,266 29,468 30,037 30,107 24,684 Directors’ fees payable 156 128 128 128 128 Accounts payable and accrued expenses 3,592 3,652 2,996 2,934 4,064 Total Liabilities $1,252,564 $1,173,405 $1,149,501 $1,096,561 $877,254 Total Net Assets $920,020 $970,320 $990,608 $986,372 $998,234 Total Liabilities and Net Assets $2,172,584 $2,143,725 $2,140,110 $2,082,933 $1,875,487 Net Asset Value per Share $17.96 $18.18 $18.15 $18.03 $18.21 Debt to Equity 1.31x 1.15x 1.11x 1.04x 0.83x Net Debt to Equity8 1.25x 1.10x 1.03x 0.96x 0.75x Shares Outstanding, end of period 51,217,252 53,387,277 54,571,650 54,705,779 54,815,740 Quarterly Balance Sheets

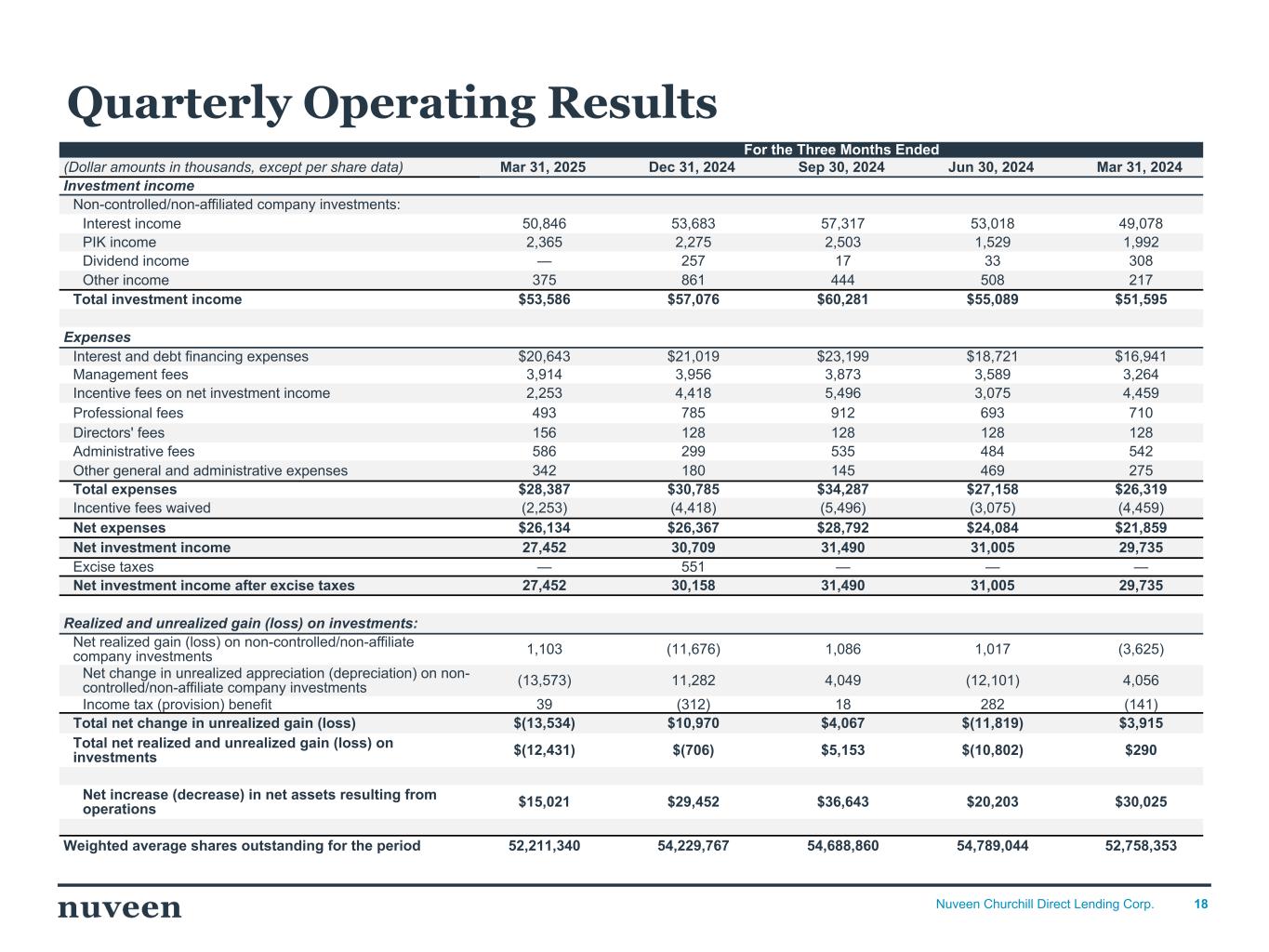

18Nuveen Churchill Direct Lending Corp. For the Three Months Ended (Dollar amounts in thousands, except per share data) Mar 31, 2025 Dec 31, 2024 Sep 30, 2024 Jun 30, 2024 Mar 31, 2024 Investment income Non-controlled/non-affiliated company investments: Interest income 50,846 53,683 57,317 53,018 49,078 PIK income 2,365 2,275 2,503 1,529 1,992 Dividend income — 257 17 33 308 Other income 375 861 444 508 217 Total investment income $53,586 $57,076 $60,281 $55,089 $51,595 Expenses Interest and debt financing expenses $20,643 $21,019 $23,199 $18,721 $16,941 Management fees 3,914 3,956 3,873 3,589 3,264 Incentive fees on net investment income 2,253 4,418 5,496 3,075 4,459 Professional fees 493 785 912 693 710 Directors' fees 156 128 128 128 128 Administrative fees 586 299 535 484 542 Other general and administrative expenses 342 180 145 469 275 Total expenses $28,387 $30,785 $34,287 $27,158 $26,319 Incentive fees waived (2,253) (4,418) (5,496) (3,075) (4,459) Net expenses $26,134 $26,367 $28,792 $24,084 $21,859 Net investment income 27,452 30,709 31,490 31,005 29,735 Excise taxes — 551 — — — Net investment income after excise taxes 27,452 30,158 31,490 31,005 29,735 Realized and unrealized gain (loss) on investments: Net realized gain (loss) on non-controlled/non-affiliate company investments 1,103 (11,676) 1,086 1,017 (3,625) Net change in unrealized appreciation (depreciation) on non- controlled/non-affiliate company investments (13,573) 11,282 4,049 (12,101) 4,056 Income tax (provision) benefit 39 (312) 18 282 (141) Total net change in unrealized gain (loss) $(13,534) $10,970 $4,067 $(11,819) $3,915 Total net realized and unrealized gain (loss) on investments $(12,431) $(706) $5,153 $(10,802) $290 Net increase (decrease) in net assets resulting from operations $15,021 $29,452 $36,643 $20,203 $30,025 Weighted average shares outstanding for the period 52,211,340 54,229,767 54,688,860 54,789,044 52,758,353 Quarterly Operating Results

19Nuveen Churchill Direct Lending Corp. Our website www.NCDL.com Investor Relations NCDL-IR@churchillam.com Contact Us

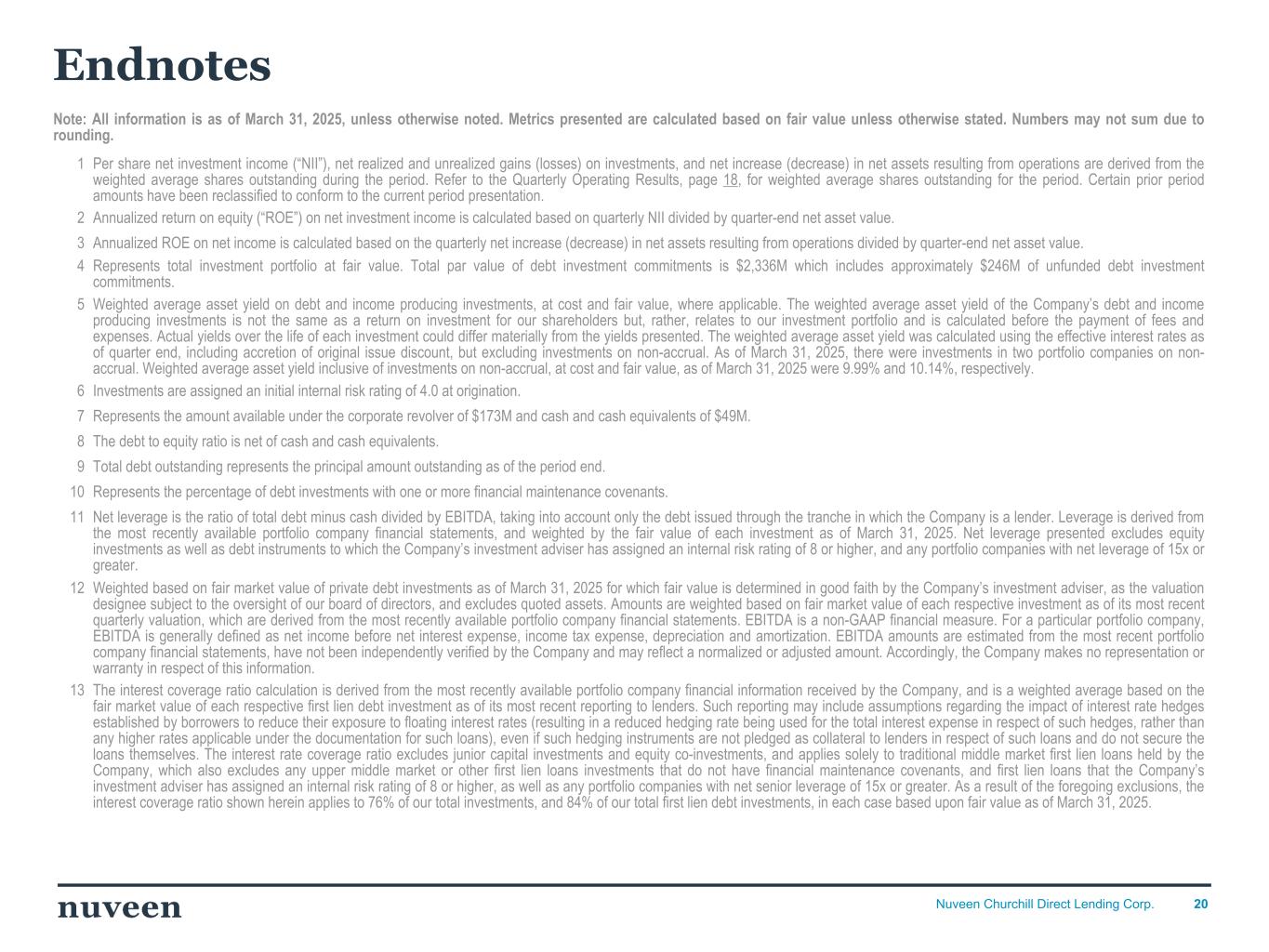

20Nuveen Churchill Direct Lending Corp. Note: All information is as of March 31, 2025, unless otherwise noted. Metrics presented are calculated based on fair value unless otherwise stated. Numbers may not sum due to rounding. 1 Per share net investment income (“NII”), net realized and unrealized gains (losses) on investments, and net increase (decrease) in net assets resulting from operations are derived from the weighted average shares outstanding during the period. Refer to the Quarterly Operating Results, page 18, for weighted average shares outstanding for the period. Certain prior period amounts have been reclassified to conform to the current period presentation. 2 Annualized return on equity (“ROE”) on net investment income is calculated based on quarterly NII divided by quarter-end net asset value. 3 Annualized ROE on net income is calculated based on the quarterly net increase (decrease) in net assets resulting from operations divided by quarter-end net asset value. 4 Represents total investment portfolio at fair value. Total par value of debt investment commitments is $2,336M which includes approximately $246M of unfunded debt investment commitments. 5 Weighted average asset yield on debt and income producing investments, at cost and fair value, where applicable. The weighted average asset yield of the Company’s debt and income producing investments is not the same as a return on investment for our shareholders but, rather, relates to our investment portfolio and is calculated before the payment of fees and expenses. Actual yields over the life of each investment could differ materially from the yields presented. The weighted average asset yield was calculated using the effective interest rates as of quarter end, including accretion of original issue discount, but excluding investments on non-accrual. As of March 31, 2025, there were investments in two portfolio companies on non- accrual. Weighted average asset yield inclusive of investments on non-accrual, at cost and fair value, as of March 31, 2025 were 9.99% and 10.14%, respectively. 6 Investments are assigned an initial internal risk rating of 4.0 at origination. 7 Represents the amount available under the corporate revolver of $173M and cash and cash equivalents of $49M. 8 The debt to equity ratio is net of cash and cash equivalents. 9 Total debt outstanding represents the principal amount outstanding as of the period end. 10 Represents the percentage of debt investments with one or more financial maintenance covenants. 11 Net leverage is the ratio of total debt minus cash divided by EBITDA, taking into account only the debt issued through the tranche in which the Company is a lender. Leverage is derived from the most recently available portfolio company financial statements, and weighted by the fair value of each investment as of March 31, 2025. Net leverage presented excludes equity investments as well as debt instruments to which the Company’s investment adviser has assigned an internal risk rating of 8 or higher, and any portfolio companies with net leverage of 15x or greater. 12 Weighted based on fair market value of private debt investments as of March 31, 2025 for which fair value is determined in good faith by the Company’s investment adviser, as the valuation designee subject to the oversight of our board of directors, and excludes quoted assets. Amounts are weighted based on fair market value of each respective investment as of its most recent quarterly valuation, which are derived from the most recently available portfolio company financial statements. EBITDA is a non-GAAP financial measure. For a particular portfolio company, EBITDA is generally defined as net income before net interest expense, income tax expense, depreciation and amortization. EBITDA amounts are estimated from the most recent portfolio company financial statements, have not been independently verified by the Company and may reflect a normalized or adjusted amount. Accordingly, the Company makes no representation or warranty in respect of this information. 13 The interest coverage ratio calculation is derived from the most recently available portfolio company financial information received by the Company, and is a weighted average based on the fair market value of each respective first lien debt investment as of its most recent reporting to lenders. Such reporting may include assumptions regarding the impact of interest rate hedges established by borrowers to reduce their exposure to floating interest rates (resulting in a reduced hedging rate being used for the total interest expense in respect of such hedges, rather than any higher rates applicable under the documentation for such loans), even if such hedging instruments are not pledged as collateral to lenders in respect of such loans and do not secure the loans themselves. The interest rate coverage ratio excludes junior capital investments and equity co-investments, and applies solely to traditional middle market first lien loans held by the Company, which also excludes any upper middle market or other first lien loans investments that do not have financial maintenance covenants, and first lien loans that the Company’s investment adviser has assigned an internal risk rating of 8 or higher, as well as any portfolio companies with net senior leverage of 15x or greater. As a result of the foregoing exclusions, the interest coverage ratio shown herein applies to 76% of our total investments, and 84% of our total first lien debt investments, in each case based upon fair value as of March 31, 2025. Endnotes

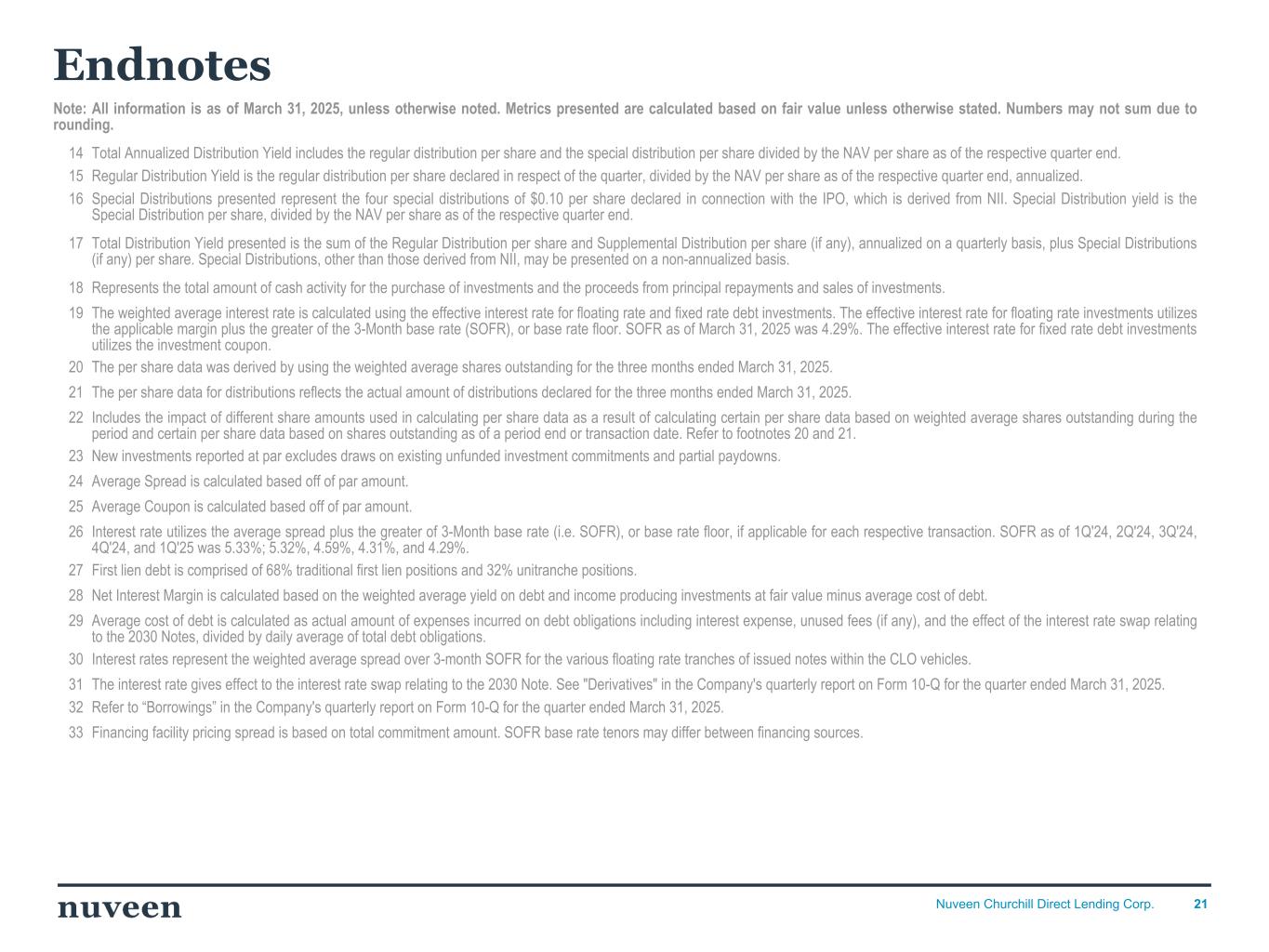

21Nuveen Churchill Direct Lending Corp. Endnotes Note: All information is as of March 31, 2025, unless otherwise noted. Metrics presented are calculated based on fair value unless otherwise stated. Numbers may not sum due to rounding. 14 Total Annualized Distribution Yield includes the regular distribution per share and the special distribution per share divided by the NAV per share as of the respective quarter end. 15 Regular Distribution Yield is the regular distribution per share declared in respect of the quarter, divided by the NAV per share as of the respective quarter end, annualized. 16 Special Distributions presented represent the four special distributions of $0.10 per share declared in connection with the IPO, which is derived from NII. Special Distribution yield is the Special Distribution per share, divided by the NAV per share as of the respective quarter end. 17 Total Distribution Yield presented is the sum of the Regular Distribution per share and Supplemental Distribution per share (if any), annualized on a quarterly basis, plus Special Distributions (if any) per share. Special Distributions, other than those derived from NII, may be presented on a non-annualized basis. 18 Represents the total amount of cash activity for the purchase of investments and the proceeds from principal repayments and sales of investments. 19 The weighted average interest rate is calculated using the effective interest rate for floating rate and fixed rate debt investments. The effective interest rate for floating rate investments utilizes the applicable margin plus the greater of the 3-Month base rate (SOFR), or base rate floor. SOFR as of March 31, 2025 was 4.29%. The effective interest rate for fixed rate debt investments utilizes the investment coupon. 20 The per share data was derived by using the weighted average shares outstanding for the three months ended March 31, 2025. 21 The per share data for distributions reflects the actual amount of distributions declared for the three months ended March 31, 2025. 22 Includes the impact of different share amounts used in calculating per share data as a result of calculating certain per share data based on weighted average shares outstanding during the period and certain per share data based on shares outstanding as of a period end or transaction date. Refer to footnotes 20 and 21. 23 New investments reported at par excludes draws on existing unfunded investment commitments and partial paydowns. 24 Average Spread is calculated based off of par amount. 25 Average Coupon is calculated based off of par amount. 26 Interest rate utilizes the average spread plus the greater of 3-Month base rate (i.e. SOFR), or base rate floor, if applicable for each respective transaction. SOFR as of 1Q'24, 2Q'24, 3Q'24, 4Q'24, and 1Q'25 was 5.33%; 5.32%, 4.59%, 4.31%, and 4.29%. 27 First lien debt is comprised of 68% traditional first lien positions and 32% unitranche positions. 28 Net Interest Margin is calculated based on the weighted average yield on debt and income producing investments at fair value minus average cost of debt. 29 Average cost of debt is calculated as actual amount of expenses incurred on debt obligations including interest expense, unused fees (if any), and the effect of the interest rate swap relating to the 2030 Notes, divided by daily average of total debt obligations. 30 Interest rates represent the weighted average spread over 3-month SOFR for the various floating rate tranches of issued notes within the CLO vehicles. 31 The interest rate gives effect to the interest rate swap relating to the 2030 Note. See "Derivatives" in the Company's quarterly report on Form 10-Q for the quarter ended March 31, 2025. 32 Refer to “Borrowings” in the Company's quarterly report on Form 10-Q for the quarter ended March 31, 2025. 33 Financing facility pricing spread is based on total commitment amount. SOFR base rate tenors may differ between financing sources.