Nuveen Churchill Direct Lending Corp. Investor Presentation Quarter Ended September 30, 2020 10 November 2020

Disclaimer This presentation is for informational purposes only. It does not convey an offer of any type and is not intended to be, and should not be construed as, an offer to sell, or the solicitation of an offer to buy, any securities of Nuveen Churchill Direct Lending Corp. (the “Company,” “we,” “us” or “our”). Any such offering can be made only at the time a qualified offeree receives a confidential private placement memorandum and other operative documents which contain significant details with respect to risks and should be carefully read. In addition, the information in this presentation is qualified in its entirety by reference to all of the information in the Company’s confidential private placement memorandum and the Company’s public filings with the Securities and Exchange Commission (the “SEC”), including without limitation, the risk factors. Nothing in this presentation constitutes investment advice. The Company’s securities have not been registered under the Securities Act of 1933 or listed on any securities exchange. You or your clients may lose money by investing in the Company. The Company is not intended to be a complete investment program and, due to the uncertainty inherent in all investments, there can be no assurance that the Company will achieve its investment objectives. The information contained herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Prospective investors should also seek advice from their own independent tax, accounting, financial, investment and legal advisors to properly assess the merits and risks associated with an investment in the Company in light of their own financial condition and other circumstances. These materials and the presentations of which they are a part, and the summaries contained herein, do not purport to be complete and no obligation to update or otherwise revise such information is being assumed. Nothing shall be relied upon as a promise or representation as to the future performance of the Company. Such information is qualified in its entirety by reference to the more detailed discussions contained elsewhere in the Company’s confidential private placement memorandum and public filings with the SEC. An investment in the Company is speculative and involves a high degree of risk. There can be no guarantee that the Company’s investment objective will be achieved. The Company may engage in other investment practices that may increase the risk of investment loss. An investor could lose all or substantially all of his, her or its investment. The Company may not provide periodic valuation information to investors, and there may be delays in distributing important tax information. The Company’s fees and expenses may be considered high and, as a result, such fees and expenses may offset the Company’s profits. For a summary of certain of these and other risks, please see the Company’s confidential private placement memorandum and public filings with the SEC. There is no guarantee that any of the estimates, targets or projections illustrated in these materials and any presentation of which they form a part will be achieved. Any references herein to any of the Company’s past or present investments or its past or present performance, have been provided for illustrative purposes only. It should not be assumed that these investments were or will be profitable or that any future investments by the Company will be profitable or will equal the performance of these investments. This presentation contains forward-looking statements that involve substantial risks and uncertainties. Such statements involve known and unknown risks, uncertainties and other factors and undue reliance should not be placed thereon. These forward-looking statements are not historical facts, but rather are based on current expectations, estimates and projections about the Company, our current and prospective portfolio investments, our industry, our beliefs and opinions, and our assumptions. Words such as “anticipates,” “expects,” “intends,” “plans,” “will,” “may,” “continue,” “believes,” “seeks,” “estimates,” “would,” “could,” “should,” “targets,” “projects,” “outlook,” “potential,” “predicts” and variations of these words and similar expressions are intended to identify forward- looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors that are outlined in the Company’s confidential private placement memorandum and public filings with the SEC, some of which are beyond our control and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. The Company is providing the information as of this date (unless otherwise specified) and assumes no obligations to update or revise any forward- looking statements, whether as a result of new information, future events or otherwise. Additionally, our actual results and financial condition may differ materially as a result of the continued impact of the novel coronavirus (“COVID-19”) pandemic, including without limitation: the length and duration of the COVID-19 outbreak in the United States as well as worldwide and the magnitude of the economic impact of that outbreak; the effect of the COVID-19 pandemic on our business prospects and the prospects of our portfolio companies, including our and their ability to achieve our respective objectives; and the effect of the disruptions caused by the COVID-19 pandemic on our ability to continue to effectively manage our business (including on our ability to source and close new investment opportunities) and on the availability of equity and debt capital and our use of borrowed money to finance a portion of our investments. All capitalized terms in the presentation have the same definitions as the Company’s 10-Q for the quarter ended September 30, 2020. Nuveen Churchill Direct Lending Corp. 2

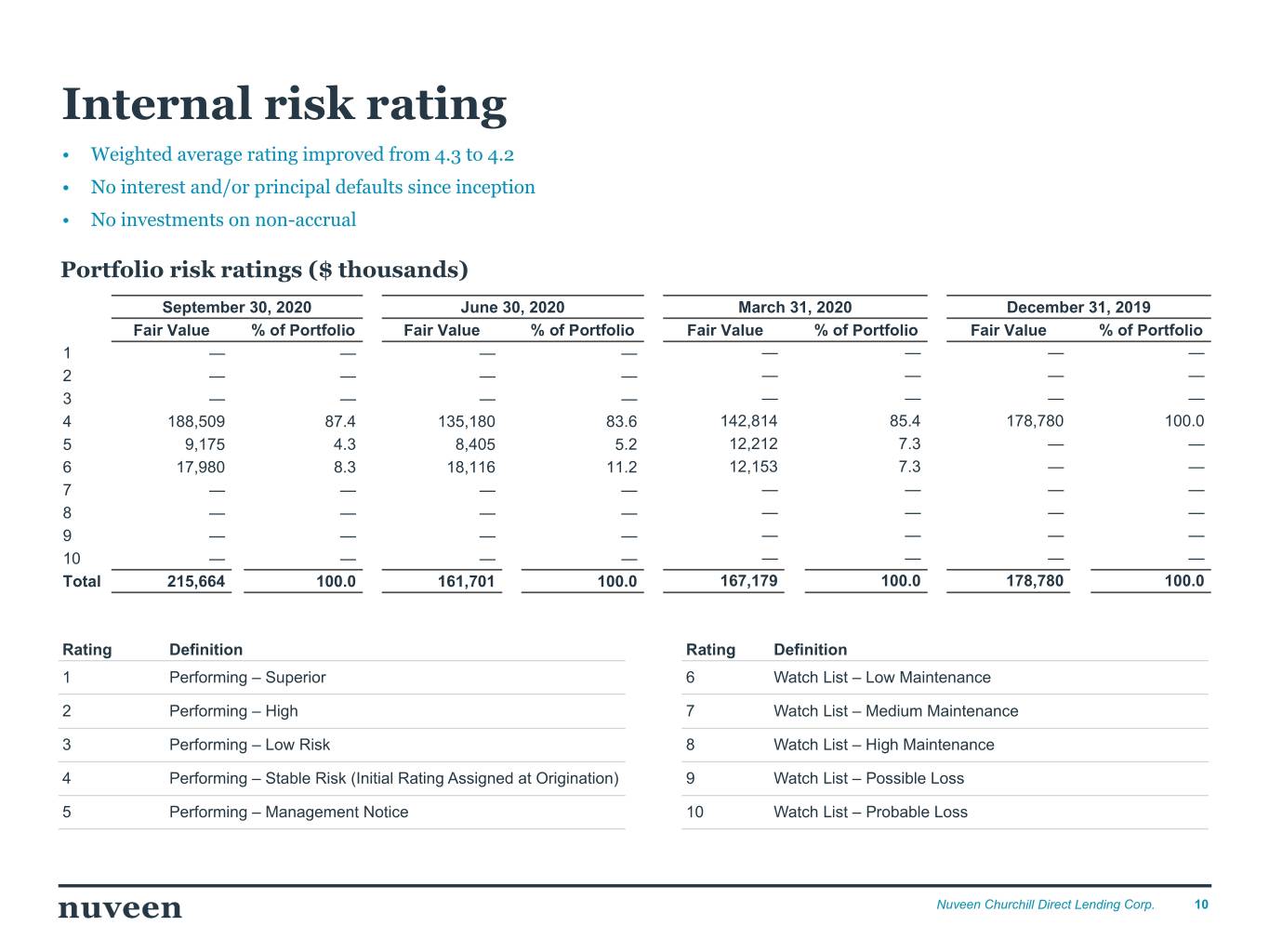

Overview Investment Activity During the third quarter of 2020, middle market deal volume and quality rebounded dramatically. The Company’s investment opportunities materially increased, with wider spreads and generally more lender-friendly terms. This trend has continued into the fourth quarter. Portfolio Update COVID-19 continues to impact the capital markets as we are proactively managing our portfolio and supporting our portfolio companies. Our experienced investment teams are working hard to preserve investor capital. The Company’s investment portfolio has not experienced any principal and/or interest defaults since inception and none of the Company’s investments are on non-accrual. Liquidity The Company has ample liquidity of $269 million1 available through uncalled committed equity capital and debt financing capacity to execute on attractive new investment opportunities. Nuveen Churchill Direct Lending Corp. 3

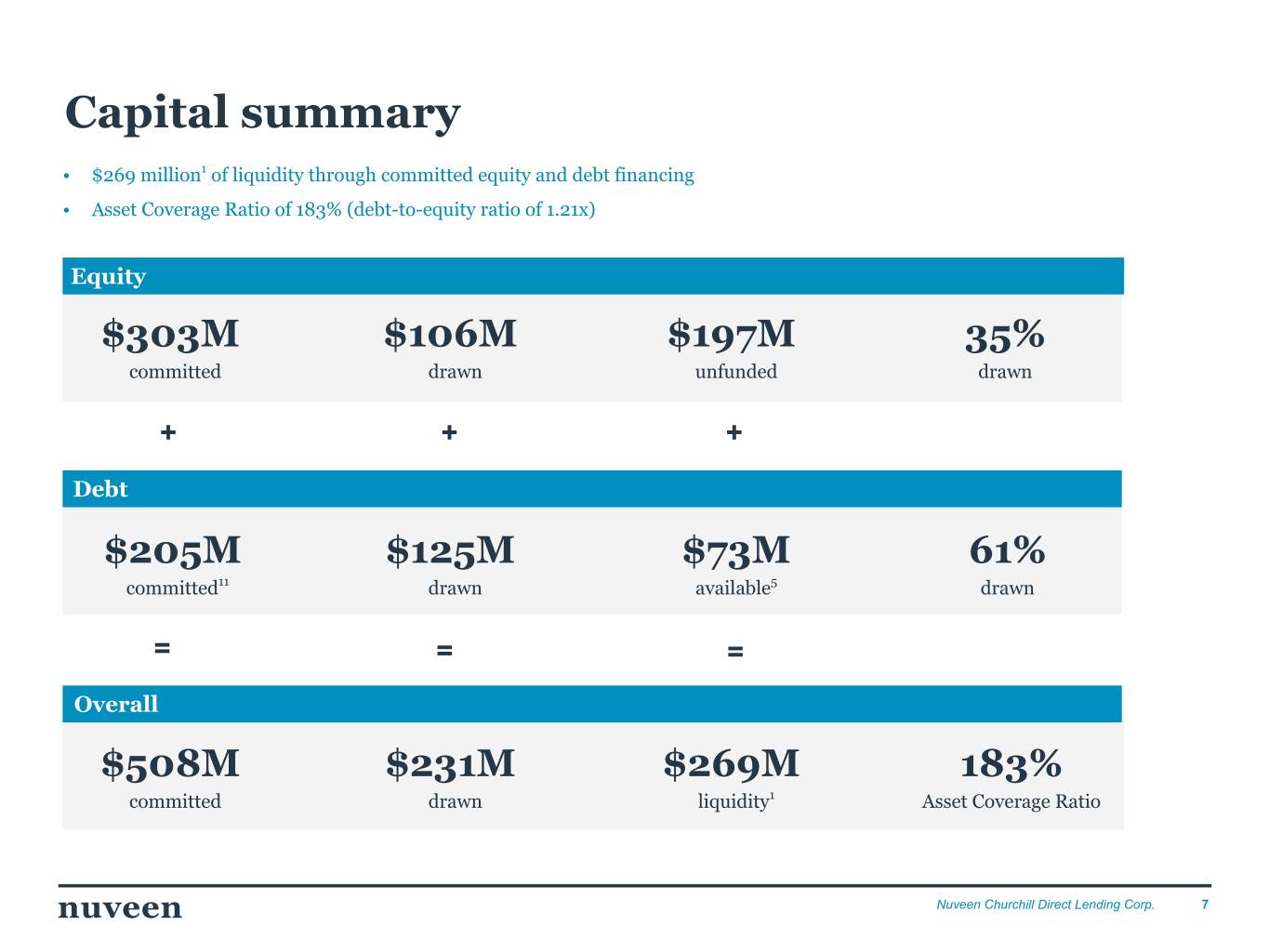

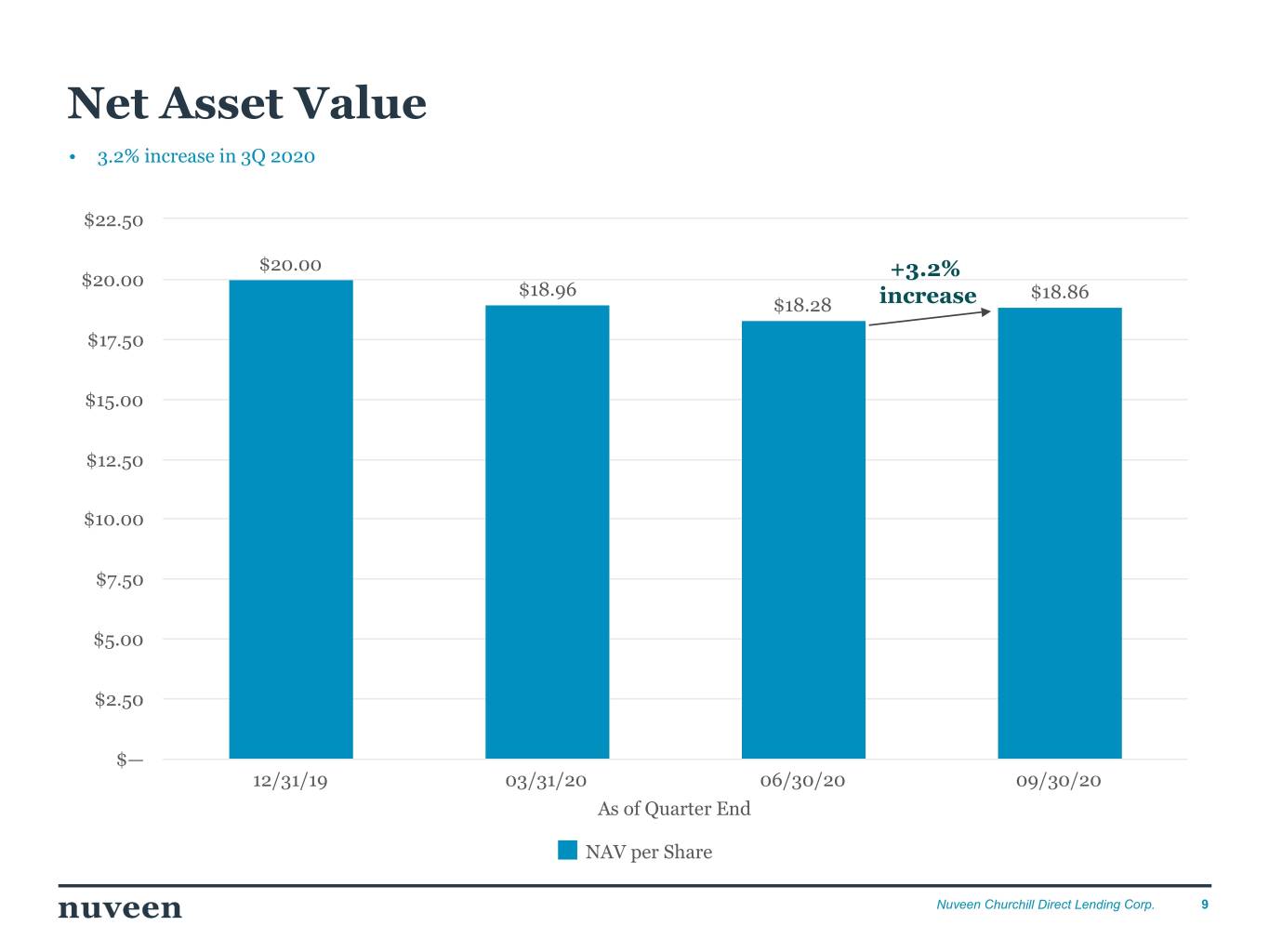

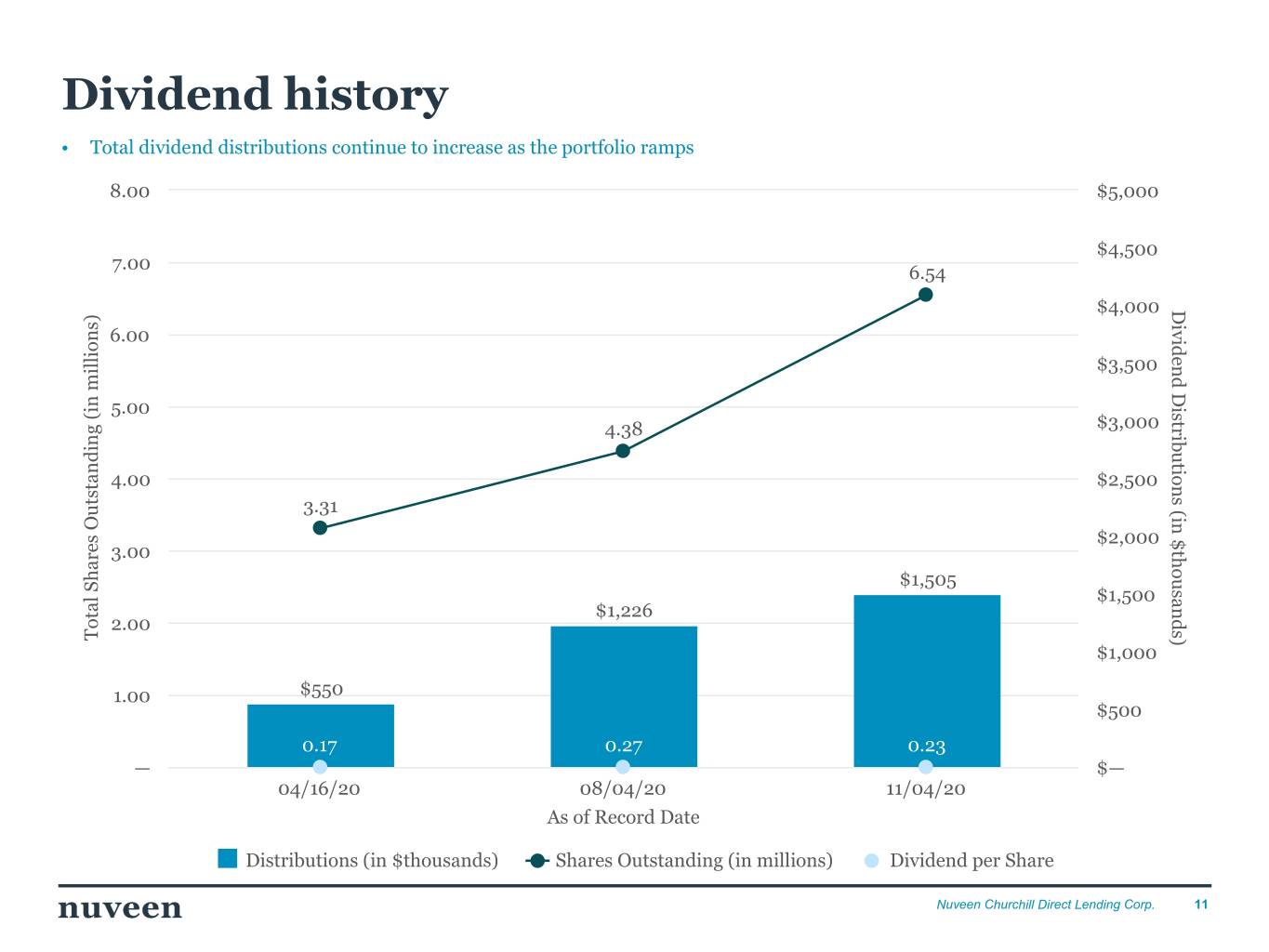

3Q20 Highlights $71M Robust pipeline and strong recovery from 2Q 2020 Investment Volume2 Investment • Investment volume increased from $12M to $71M (+514%) Activity • Average spread of floating rate investments increased by 83 bps to 598 bps (+16%) • Added junior capital and equity investments to the portfolio 12 Investments Upward trend in total dividend distributions since inception Dividends / • Declared dividends of $1.5M (23% increase from 2Q20) NAV • NAV increased from $18.28 to $18.86 (3.2% increase) $5.9M Avg. Investment Size Well-positioned with ample liquidity to support portfolio growth • Closed $11M+ equity commitments • Closed $30M Subscription Facility 598 bps 3 Liquidity • Liquidity: Average Spread ◦ Unfunded equity commitments: $197 million ◦ Financing facility availability: $73 million5 ◦ Dry powder: $269 million1 96% First Lien4 Nuveen Churchill Direct Lending Corp. 4

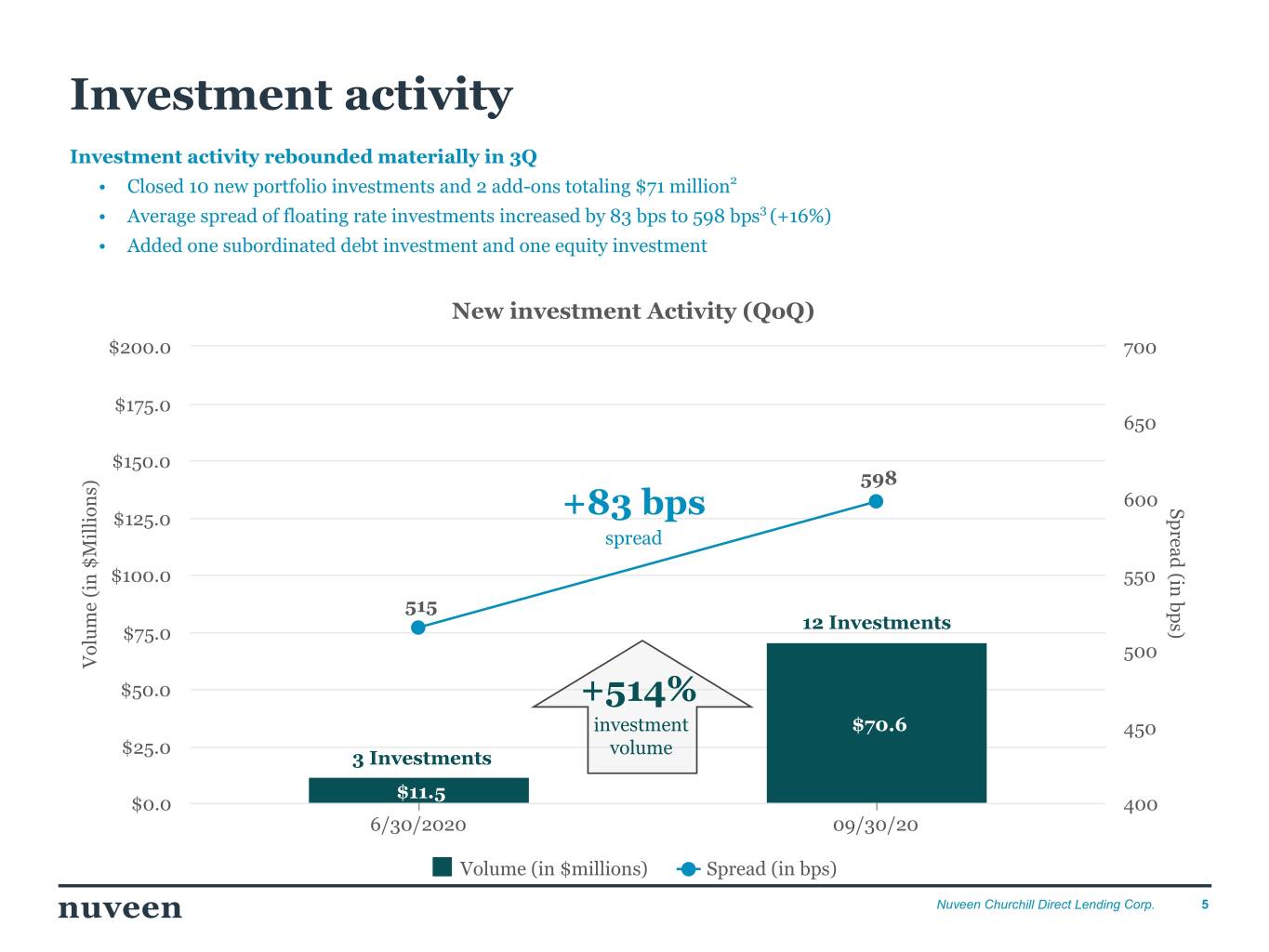

Investment activity Investment activity rebounded materially in 3Q • Closed 10 new portfolio investments and 2 add-ons totaling $71 million2 • Average spread of floating rate investments increased by 83 bps to 598 bps3 (+16%) • Added one subordinated debt investment and one equity investment New investment Activity (QoQ) $200.0 700 $175.0 650 $150.0 598 600 Sp read (in bps) $125.0 +83 bps spread $100.0 550 515 12 Investments $75.0 500 Vo lume (in $Millions) $50.0 +514% investment $70.6 450 $25.0 volume 3 Investments $11.5 $0.0 400 6/30/2020 09/30/20 Volume (in $millions) Spread (in bps) Nuveen Churchill Direct Lending Corp. 5

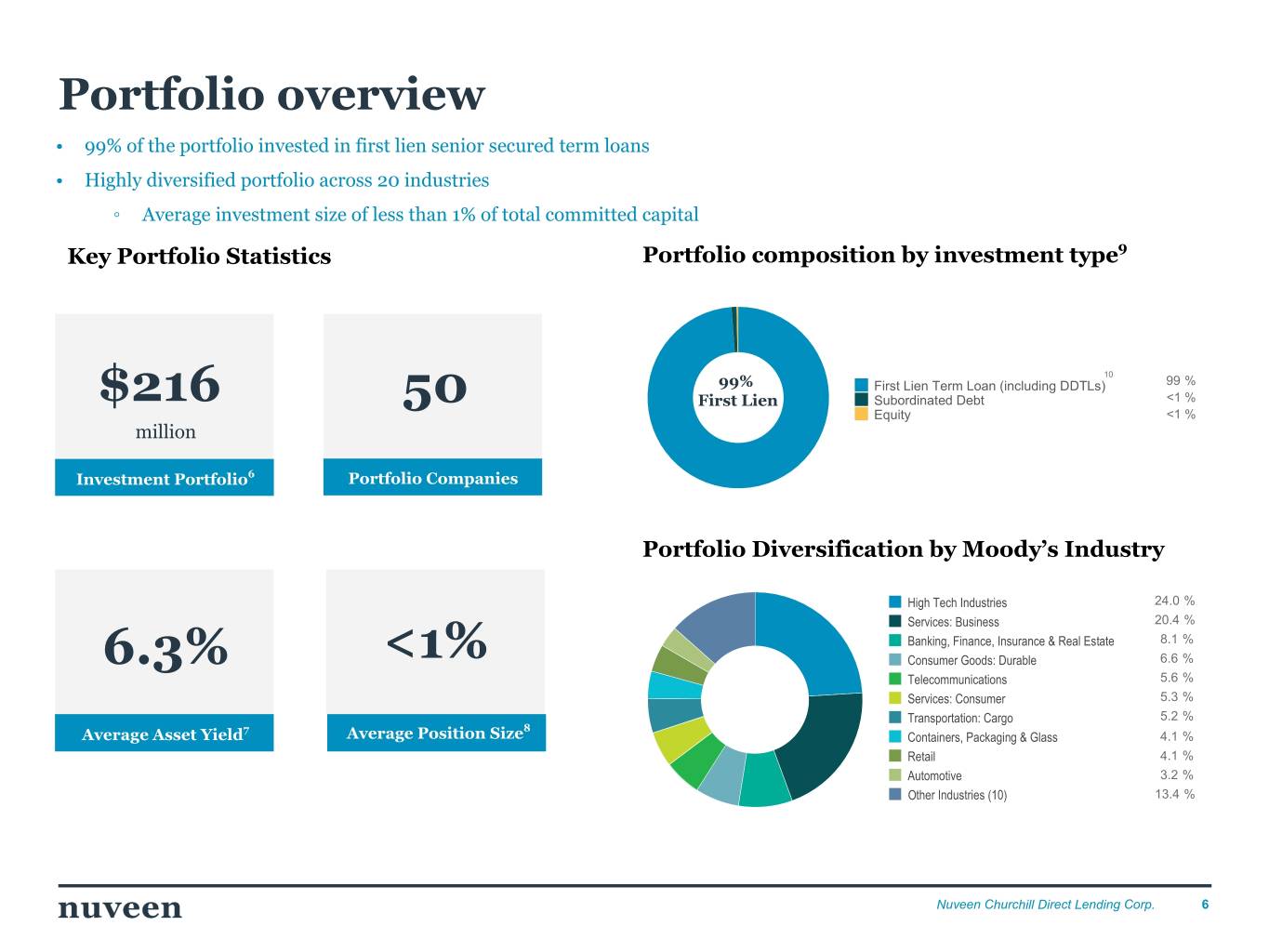

Portfolio overview • 99% of the portfolio invested in first lien senior secured term loans • Highly diversified portfolio across 20 industries ◦ Average investment size of less than 1% of total committed capital Key Portfolio Statistics Portfolio composition by investment type9 10 99% First Lien Term Loan (including DDTLs) 99 % $216 50 First Lien Subordinated Debt <1 % Equity <1 % million Investment Portfolio6 Portfolio Companies Portfolio Diversification by Moody’s Industry High Tech Industries 24.0 % Services: Business 20.4 % Banking, Finance, Insurance & Real Estate 8.1 % 6.3% <1% Consumer Goods: Durable 6.6 % Telecommunications 5.6 % Services: Consumer 5.3 % Transportation: Cargo 5.2 % 7 8 Average Asset Yield Average Position Size Containers, Packaging & Glass 4.1 % Retail 4.1 % Automotive 3.2 % Other Industries (10) 13.4 % Nuveen Churchill Direct Lending Corp. 6

Capital summary • $269 million1 of liquidity through committed equity and debt financing • Asset Coverage Ratio of 183% (debt-to-equity ratio of 1.21x) Equity $303M $106M $197M 35% committed drawn unfunded drawn + + + Debt $205M $125M $73M 61% committed11 drawn available5 drawn = = = Overall $508M $231M $269M 183% committed drawn liquidity1 Asset Coverage Ratio Nuveen Churchill Direct Lending Corp. 7

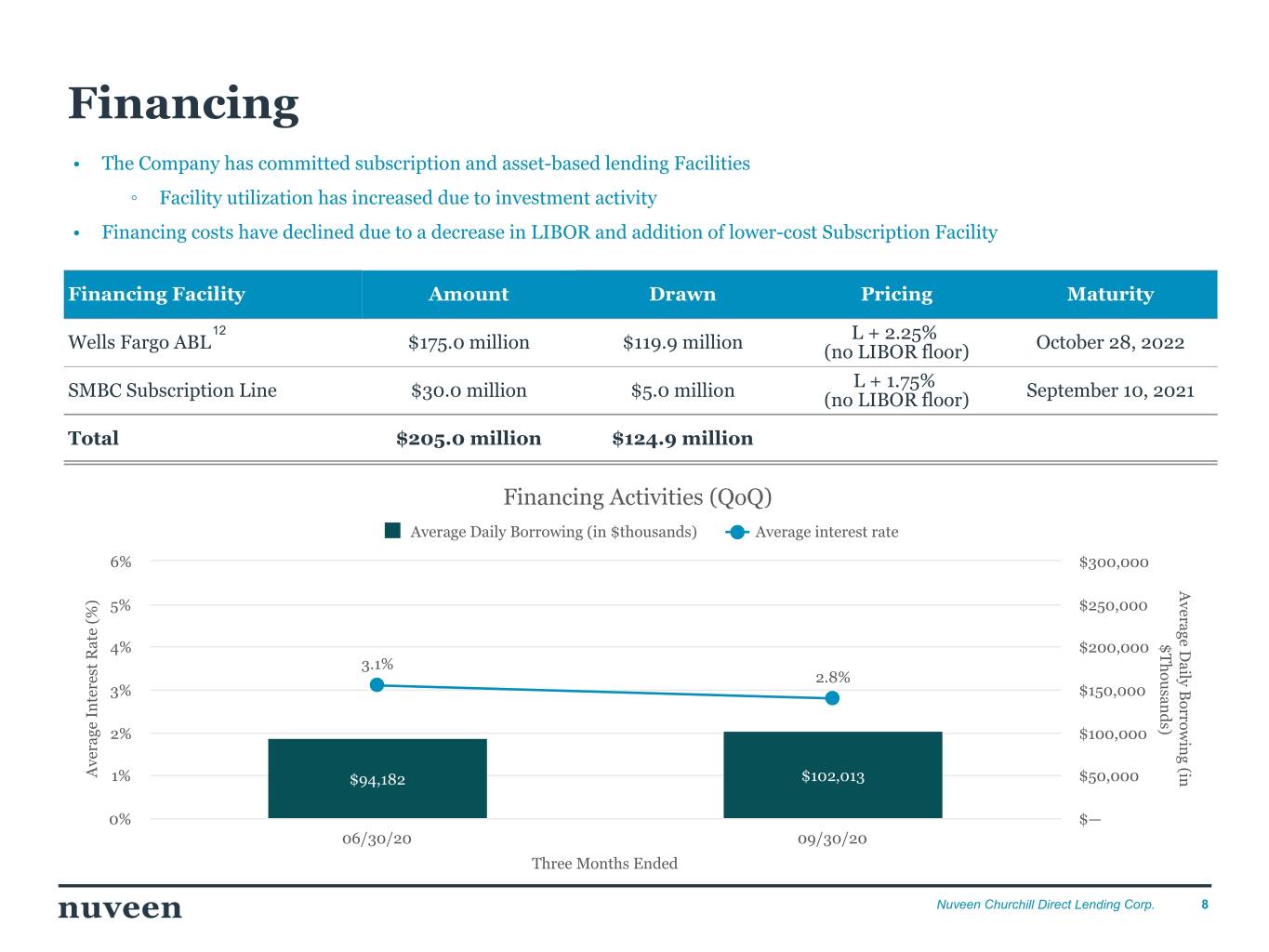

Financing • The Company has committed subscription and asset-based lending Facilities ◦ Facility utilization has increased due to investment activity • Financing costs have declined due to a decrease in LIBOR and addition of lower-cost Subscription Facility Financing Facility Amount Drawn Pricing Maturity 12 L + 2.25% Wells Fargo ABL $175.0 million $119.9 million (no LIBOR floor) October 28, 2022 L + 1.75% SMBC Subscription Line $30.0 million $5.0 million (no LIBOR floor) September 10, 2021 Total $205.0 million $124.9 million Financing Activities (QoQ) Average Daily Borrowing (in $thousands) Average interest rate 6% $300,000 Av erage Daily Borrowing (in 5% $250,000 $T housands) 4% $200,000 3.1% 2.8% 3% $150,000 2% $100,000 Av erage Interest Rate (%) 1% $94,182 $102,013 $50,000 0% $— 06/30/20 09/30/20 Three Months Ended Nuveen Churchill Direct Lending Corp. 8

Net Asset Value • 3.2% increase in 3Q 2020 $22.50 $20.00 $20.00 +3.2% $18.96 $18.86 $18.28 increase $17.50 $15.00 $12.50 $10.00 $7.50 $5.00 $2.50 $— 12/31/19 03/31/20 06/30/20 09/30/20 As of Quarter End NAV per Share Nuveen Churchill Direct Lending Corp. 9

Internal risk rating • Weighted average rating improved from 4.3 to 4.2 • No interest and/or principal defaults since inception • No investments on non-accrual Portfolio risk ratings ($ thousands) September 30, 2020 June 30, 2020 March 31, 2020 December 31, 2019 Fair Value % of Portfolio Fair Value % of Portfolio Fair Value % of Portfolio Fair Value % of Portfolio 1 — — — — — — — — 2 — — — — — — — — 3 — — — — — — — — 4 188,509 87.4 135,180 83.6 142,814 85.4 178,780 100.0 5 9,175 4.3 8,405 5.2 12,212 7.3 — — 6 17,980 8.3 18,116 11.2 12,153 7.3 — — 7 — — — — — — — — 8 — — — — — — — — 9 — — — — — — — — 10 — — — — — — — — Total 215,664 100.0 161,701 100.0 167,179 100.0 178,780 100.0 Rating Definition Rating Definition 1 Performing – Superior 6 Watch List – Low Maintenance 2 Performing – High 7 Watch List – Medium Maintenance 3 Performing – Low Risk 8 Watch List – High Maintenance 4 Performing – Stable Risk (Initial Rating Assigned at Origination) 9 Watch List – Possible Loss 5 Performing – Management Notice 10 Watch List – Probable Loss Nuveen Churchill Direct Lending Corp. 10

Dividend history • Total dividend distributions continue to increase as the portfolio ramps 8.00 $5,000 $4,500 7.00 6.54 $4,000 Di vidend Distributions (in $thousands) 6.00 $3,500 5.00 4.38 $3,000 4.00 $2,500 3.31 $2,000 3.00 $1,505 $1,500 $1,226 2.00 To tal Shares Outstanding (in millions) $1,000 1.00 $550 $500 0.17 0.27 0.23 — $— 04/16/20 08/04/20 11/04/20 As of Record Date Distributions (in $thousands) Shares Outstanding (in millions) Dividend per Share Nuveen Churchill Direct Lending Corp. 11

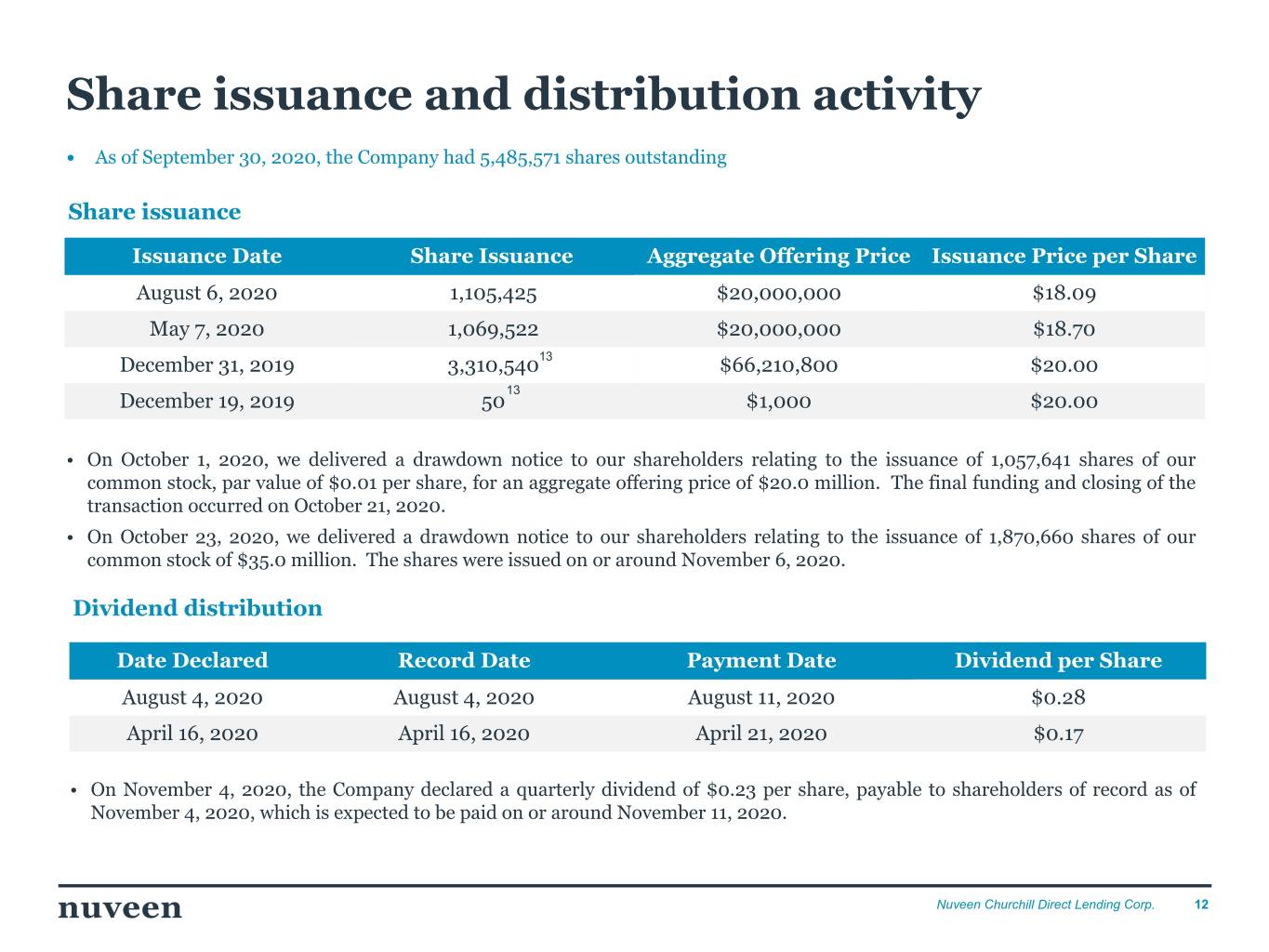

Share issuance and distribution activity • As of September 30, 2020, the Company had 5,485,571 shares outstanding Share issuance Issuance Date Share Issuance Aggregate Offering Price Issuance Price per Share August 6, 2020 1,105,425 $20,000,000 $18.09 May 7, 2020 1,069,522 $20,000,000 $18.70 December 31, 2019 3,310,54013 $66,210,800 $20.00 13 December 19, 2019 50 $1,000 $20.00 • On October 1, 2020, we delivered a drawdown notice to our shareholders relating to the issuance of 1,057,641 shares of our common stock, par value of $0.01 per share, for an aggregate offering price of $20.0 million. The final funding and closing of the transaction occurred on October 21, 2020. • On October 23, 2020, we delivered a drawdown notice to our shareholders relating to the issuance of 1,870,660 shares of our common stock of $35.0 million. The shares were issued on or around November 6, 2020. Dividend distribution Date Declared Record Date Payment Date Dividend per Share August 4, 2020 August 4, 2020 August 11, 2020 $0.28 April 16, 2020 April 16, 2020 April 21, 2020 $0.17 • On November 4, 2020, the Company declared a quarterly dividend of $0.23 per share, payable to shareholders of record as of November 4, 2020, which is expected to be paid on or around November 11, 2020. Nuveen Churchill Direct Lending Corp. 12

Endnotes Note: all information are as of September 30, 2020, unless otherwise noted. Numbers may not sum due to rounding. 1. Represents the sum of unfunded equity commitments of $197 million and Financing Facility Available of $73 million . 2. Reflects the par amount of total new investment activity for the three months ended September 30, 2020. Investment Activity does not include existing draws on Delayed Draw Term Loans and partial paydowns. 3. Average Spread is calculated based off of par amount. 4. 47% of first lien terms loans are unitranche positions. 5. Available for borrowing based on the computation of collateral to support the borrowings and subject to compliance with applicable covenants and financial ratios. 6. Represents total investment portfolio at Fair Value. Total par value of investment commitments is $232.8 million which includes approximately $10.7 million of unfunded delayed draw term loan commitments. 7. Weighted average yield on debt and income producing investments, at fair value. The weighted average yield of the Company’s debt and income producing securities is not the same as a return on investment for our shareholders but, rather, relates to our investment portfolio and is calculated before the payment of all of our and our subsidiaries’ fees and expenses. The weighted average yield was computed using the effective interest rates as of each respective date, including accretion of original issue discount. 8. Average Position Size (at fair value) is calculated as a percentage of Committed Capital. Committed Capital includes Equity Commitment of $302.7 million as of September 30, 2020 and $205.0 million million from the Financing Facility. 9. Investment Type reflects classification at issuance. 10. 28% of first lien term loans are unitranche positions. 11. Represents current Financing Facility amount. 12. On October 28, 2020, we amended the Wells Fargo ABL Facility. The amendment increased the maximum facility amount available from $175 million to $275 million, and extended the reinvestment period to October 28, 2023 and the maturity date to October 28, 2025, among other changes. 13. Shares held by an affiliate of the Company, TIAA. Nuveen Churchill Direct Lending Corp. 13

Contact us Company website churchillam.com/NCDL Investor Relations NCDL-IR@churchillam.com Nuveen Churchill Direct Lending Corp. 14